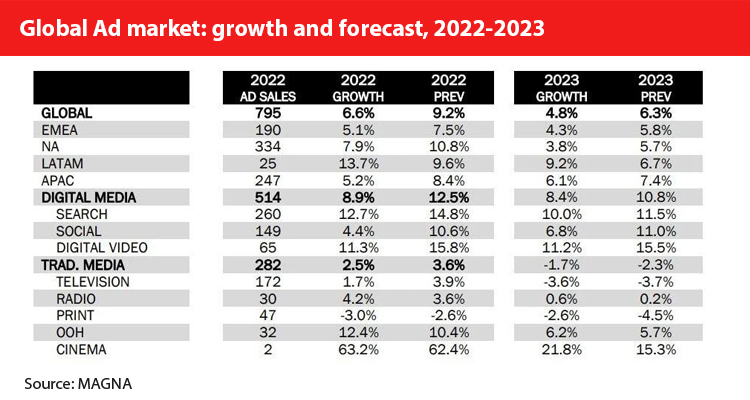

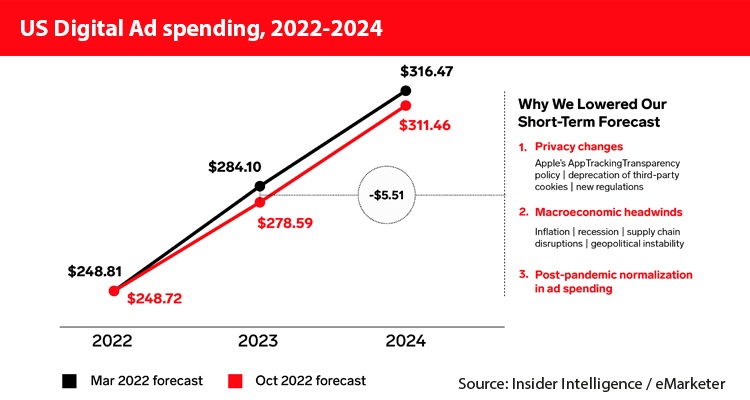

Last year, the advertising segment had an upgrade but due to global economic uncertainty and the problems affecting advertising formats, since its second semester, the growth of advertising spending has slowed significantly. Macroeconomic conditions continue deteriorating and advertisers analyze their budgets while they reduce the spending on some channels more than others.

Some consultancy firms think that this 2023, advertising once again will face a turbulent year and according to their forecasts, the investment will be slower than originally expected: Global advertising investment will grow by 3.8% to reach USD 740.000 million, and despite the economic slowdown that is facing the world economy, in 2024 a 4.8% is expected.

GroupM studied 58 markets and indicated that digital spending will continue to lead with 57.1% reaching USD 422.800 million by the end of this year. These figures will be supported by the increase in channels such as video (+7.1%), paid social networks (+13.5%), search (+7.2%), and retail media (+22 %). Television advertising investment will increase by 0.2% to reach USD 182.700 million; external advertising will do so by +2%; cinema by +6.1%; and audio by +2%. Newspapers and magazines will continue to decline with a forecast of -3.6% f this 2023.

‘This Year Next Year’ report from GroupM also ensures that 2023 global advertising will grow 5.9% with great profits in connected television, retail media, and fast-growing markets such as India.

Across companies’ media, Marketing Dive also thinks that advertising revenue in this segment will reach USD 833.000 million by the end of the year, up 5% from USD 795.000 million in 2022. The expected growth rate for this year is 1.5 percentage points lower compared to last June’s forecast, a recession that the company attributes to the deteriorating macroeconomic environment.

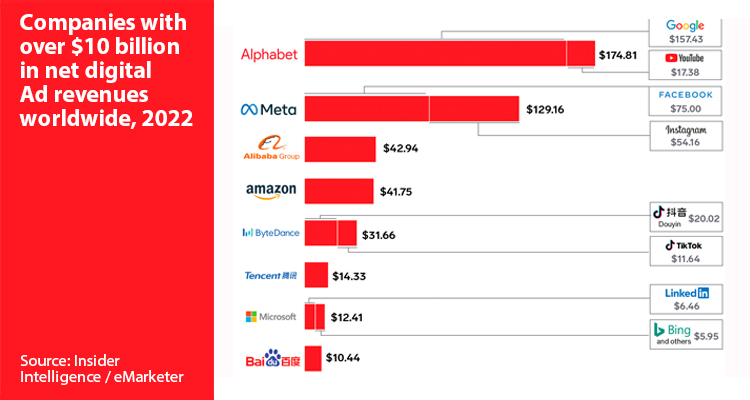

Insider Intelligence also highlights that this year digital spending will reach USD 567.49 billion. The consultant indicated that the top 5 digital advertising sales companies are: Google USD 168.44; Target USD 112.68 billion; Alibaba USD 41.01 billion; Amazon USD 37.99 billion; and Bytedance USD 29.07 billion.

Regarding country markets, Magna predicts that 2023 will be a slower year for US advertisers with sales growing just 4% to USD 330 billion. The firm expects advertising spending will grow by 6%, with a market recovery in the second semester. Advertising sales for publishing and television will decline by 3% and 4% respectively in 2023. Digital advertising sales are expected to grow 8%, reaching USD 557 billion in global sales and reflecting 65% of advertising sales. The driving factors behind digital ad sales will be e-commerce and continuing changes in media consumption habits, with digital video expected to be the fastest-growing ad format. A social media recovery could increase ad sales by 7% in this segment, while the search is expected to increase by 10%.

Meanwhile, major global markets such as China and India could see a recovery in 2023: APAC ad revenue will rise 6% to USD 263.000 million, 23% above the pre-COVID spending level, driven by the growth of digital advertising (+70%). China, the second largest ad market (15% of global ad revenue), will accelerate again in 2023 (7% increase to USD 128.000 million) after a historically weak performance in 2022 (+3%) due to the zero policy of COVID. Among the world’s top 15 ad markets, the biggest growth in 2023 will come from India (+14%) and South Korea (+7%).

As for Europe, Statista, last year European advertising investment reached its highest figure, of USD 146.000 million. But this year, most of the countries of the continent will have drops in television advertising, especially in Germany, France, and the United Kingdom. Considering the war in Ukraine, GroupM and Magna agree on their forecast for the European Community and assure that they will have little growth in 2023, below 3% in all media.