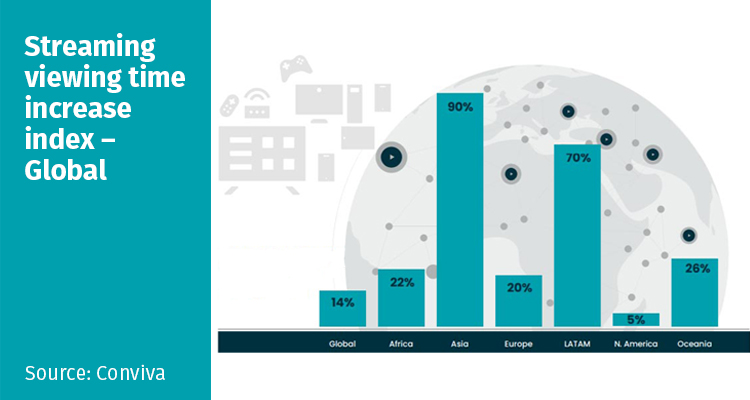

Reporting an extreme acceleration of streaming globally, the consulting firm Conviva outlined in its latest “State of Streaming” report that Asia and LatAm have the highest streaming viewing rates in the world, with 90% and 70% increase in viewing time.

However, the consultancy highlights that the same drivers are the cause of the complications of the platforms to achieve success in some markets: Device fragmentation, saturation of streaming services and viewer expectations in terms of interface, sound and visual quality, are some of the hot spots that have to be taken into account to be relevant.

Consumption habits by markets

With a global viewing time growth rate of 14%, the consultancy reported that in addition to Asia and LatAm, the North American market has seen single-digit growth for the past year, continued that trend with a modest 5% increase in streaming viewing, as well as Europe growth in a 20%. In both markets, the consulting firm thinks that the region shows a maturing marketplace.

While Africa and Oceania, which showed 22% and 26% respectively, were considered key markets with great opportunities for content and platform entry.

Among the index that Conviva analyzed for this report, is what they call «Global Quality», where they list elements typical of streaming services such as bitrate, buffering and video start time (VST).

Bitrates rose universally across all major regions, screen types and devices by 13.6%, meaning services are responding to audience demand for higher quality by publishing more of their content, the consultancy says. With qualities such as 4K, HDR and special audio, even the content released prior to these improvements has been adapted to generate superior experiences.

Conviva believes that while improvements were made across the board for all regions in buffering and bitrate, the opposite was true for video start time (VST). Bitrate showed substantial improvements across all regions: Oceania led the category with an impressive 10.68 followed by LATAM with 9.54 and Europe with 7.58. Asia, which has the highest percentage of mobile streaming hours, had the lowest average bitrate at 5.45.

While, on average, VST increased in all regions outside of North America, where it experienced a -1.2% decrease to 4.2 seconds. Europe provided the fastest video start time at 4.13 seconds, followed by North America at 4.2. Viewers from Africa and LATAM face the longest VST at 7.51 and 6.86 seconds respectively.

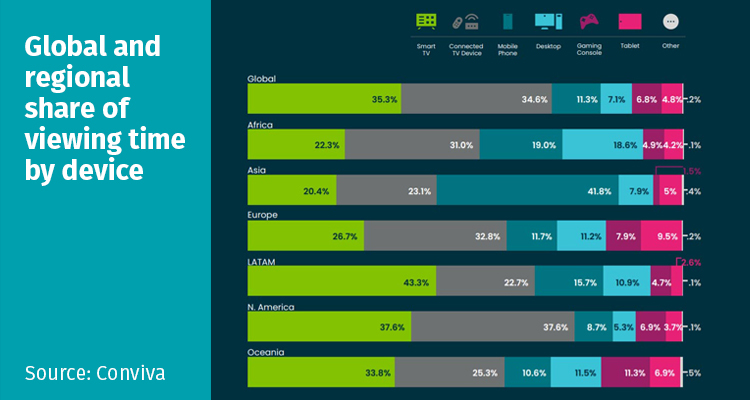

Another point highlighted by the report refers to how the world streams content. Although mobile usage continues to make its way into emerging markets, Conviva reports the majority of the world’s streaming hours happen on big screens, but every region does it a little bit: Smart TVs, Connected TV devices and gaming consoles total 76.7 of all viewing hours. While mobile phones captured the third-largest share by device at 11.3% globally, followed by desktops at 7.1%, gaming consoles at 6.8%, and tablets at 4.8%.

Noth America and LatAm were ranked with the largest share of big-screen viewing at 82.1% and 43.3% respectively(smart TV and connected TV).

Asia says showing a notable tendency to view streaming content on mobile phones, tablets and desktops, accounting for 54.7% of all streaming hours in the region.

Live Streaming and Ads

While VOD dominates the streaming market, with four-fifths of all content streamed, the business has started becoming saturated and segmented, that’s why companies are trying to struggle to differentiate themselves from the rest of the competition and capture new subscribers, and live content has been part of this movement.

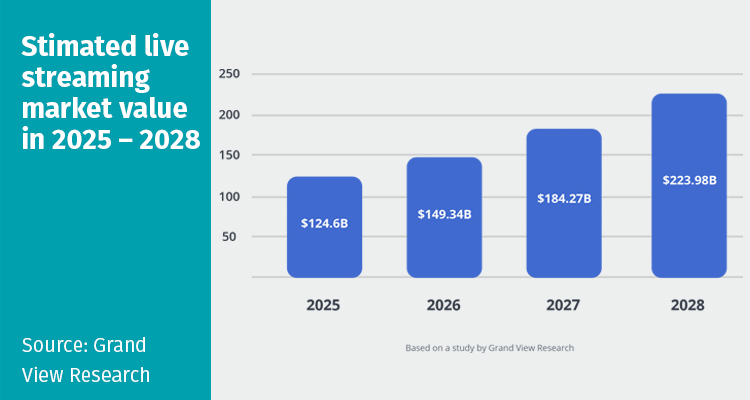

And it is that live streaming is booming, and several projections indicate that it will increase from 70,000 million in 2021 to almost 224,000 million in 2028. This is because live streaming content represents what viewers are used to watching on linear TV and their expectations are similar.

On the other hand, the global qualities in this type of content are significantly better than VOD content. Conviva says that viewers expect different experiences from these two very different types of content. This requires streaming publishers to leverage two different strategies to maximize the customer experience. Live content needs to be delivered fast with as little buffering as possible, and VOD content needs to look like a HD movie.

Within this same spectrum, streaming ads is here to stay. And it is that nearly every major streaming service announced an ad-supported option over the past year. Conviva reported that compared to Q1 2022 that there were 25% more ad impressions recorded Q2, even advertisers are also opting for shorte ads, recorded a 16% decrease in ad duration between the first and second quarters of 2022.

In this area, the FAST model seems to continue gaining popularity, introducing innovations such as linear-like channels which in turn led to a new group of players in the FAST ecosystem—studios, cable networks and other publishers that provide much of the programming for those linear channels.

And it is that in the race for FAST interfaces, the market continues to be segmented between Connected TVs devices, with players like Roku, Amazon, Google and Apple and aggregators like Pluto TV, Peackock, Xumo and Tubi.