Despite an up and down 2020, fueled by COVID restrictions, SVOD continued to expand, with more service launched and content offered. Prensario reviews some of the most recent insights in the segment, such as the proliferation of platforms, subscriber growth, penetration and new strategies into the segment

In the UK, according to BARB, during Q4 2021, the operators reported more than 19.1 million households with access to SVOD; Meanwhile, Kantar assured that 85% of households in the US have at least a subscription to an SVOD service (+2% QoQ, and +2% YoY compared to 2020), for a total of 109.4 million households with subscriptions.

The same report showed that in the USA, 4.7 SVOD services were acquired on average per household, highlighting that 9% of households in this territory accessed a new platform in the last quarter of 2021. The consultant explained that the sector of streaming was boosted by FAST and AVOD, where QoQ penetration growth came from both service models: FAST growing 4.9%, AVOD 3.6%, and SVOD 1.8 per cent points QoQ.

Netflix, Amazon Prime Video and Now (Sky) posted small quarterly gains in this territory, with Disney+ showing the largest increase in the number of households with the service, up nearly 5% from Q3 2021: 5.5 million of households accessed Disney+ in the fourth quarter of 2021.

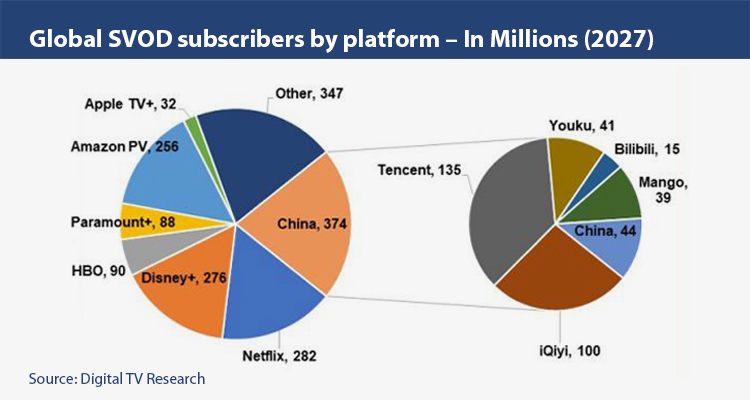

Latin America, one of the most competitive markets for SVODs, saw a growth in the number of users of this type of service in that region increased by over 40 percent, surpassing 60 million in the latter year, according to Statista. In many countries on this continent at least one-third of consumers subscribed to two or more video streaming services in 2020; where Netflix stands as one of the main platforms, with a total of 38.6 million subscribers. Both, Statista and consultancy firm Digital TV Research, expressed that the subscribers will peak to 130 million by 2026.

Spending

With the confirmation that people continued to add SVOD subscriptions in 2021, Digital Entertainment Group (DEG.) also mentioned on a recent whitepaper that spending on SVOD services in the US in Q3 2020 was $5.5 billion. In Q3 2021, spending had increased 17%, reaching $6.4 billion.

On this aspect, some platform prices increased last two years: Netflix price rises from USD 1 and USD 2 went into effect in February of 2021, and Disney+ up prices USD 1 in April. However, many services didn’t increase prices, and some even lowered them or plans to introduce an ad-supported tier of service for a discount.

Saturation

According to Flixed, there are more than 200 streaming providers in the world, and it’s growing. With houses acquiring 3 or more subscriptions, some studies suggest that this is driven by the growth of premium content.

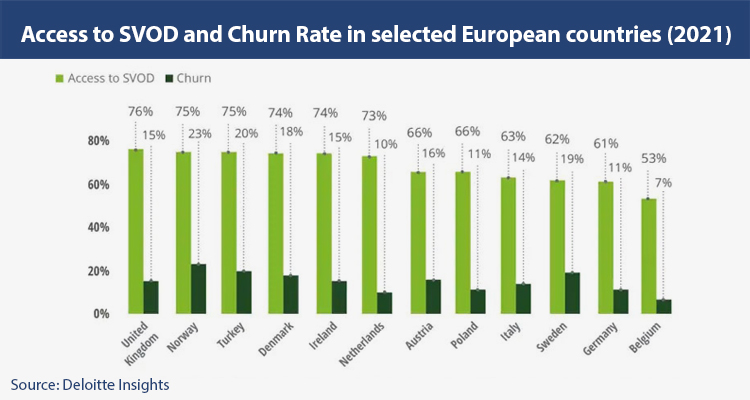

According to Hub Entertainment Research, about a third of subscribers signed up to a platform because of a show that wasn’t available elsewhere. And although after a period of rapid growth, during the pandemic and restrictions in some countries, the latest earnings reports of some SVOD have attested to a slowdown or slow growth: Disney published in its October 2021 report which found 2.1 million net new subscribers worldwide, up from 12.1 million in the previous quarter. Likewise, other recently launched services (Peacock, HBO Max and Paramount) have reported slow growth. That is why some media consultants such as Deloitte predict that in 2022 the rotation of SVOD platforms will increase by 30%, and it is expected that 150 million subscribers will cancel at least one service.

But some companies are already looking to deal with this situation and sustain growth: Netflix will continue to capitalize on talent and new IPs, while expanding into new verticals such as gaming. While Amazon expects good results after acquiring MGM’s content library for 8.5 billion dollars, which is made up of classics from the lion studios. As well as mergers, which seek to boost streaming verticals such as TelevisaUnivision, who joined forces to launch ViX and ViX+ with a focus on the Hispanic market. Or the merger of HBO Max and Discovery+, or the incorporation of WWE Network to Peacock.

FAST gains field

According to Kantar and its Entertainment on Demand report, about 18% of US households now use a FAST service as of the fourth quarter of 2021. According to the consultancy, this trend has seen a year-on-year doubling ‘when penetration in households was 8% in the fourth quarter of 2020,’ reports the whitepaper. On that note, FAST’s penetration increased 4.9%, making it the fastest growing streaming vertical over the past year. Almost the size of AVOD, which has a 24% household penetration in the US.

Within FAST, Peacock, Amazon’s IMDB, FOX Entertainment’ Tubi and Roku stand out as the forms that capitalize on the majority of users in this territory, who together represent 79% of all new users.

More information on FAST can be founded in the special report of this MIPTV edition