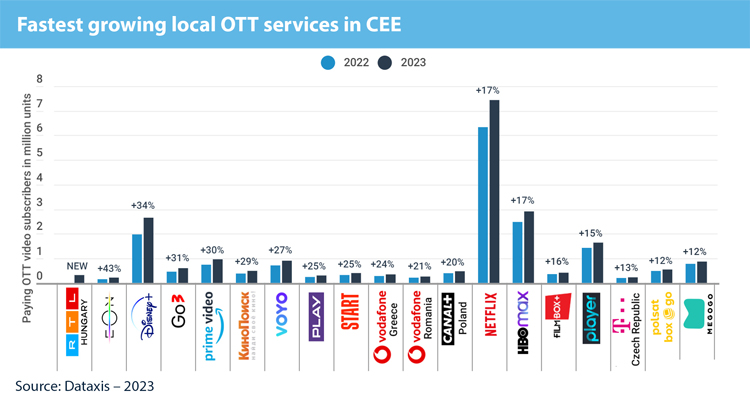

Central European OTT platforms are witnessing a period of remarkable growth and transformation. These homegrown services have redefined their interfaces, strategies, and business models to capture the attention of new users. This dynamic shift is challenging the dominance of global OTT giants like Netflix, HBO Max, and Amazon Prime Video. In some markets, local platforms have even surpassed these international competitors in subscriber volumes.

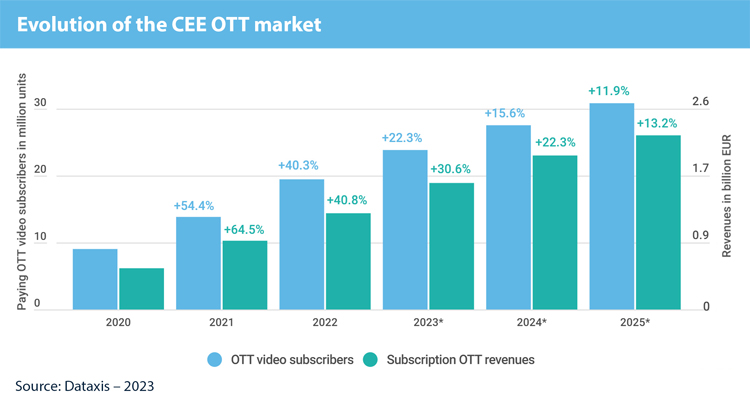

In recent years, the CEE markets have seen a convergence in the number of OTT subscribers between regional and global platforms. Up until 2021, regional OTT platforms had 6.9 million subscribers, while American streaming services boasted 7.1 million, according to Dataxis. The landscape shifted significantly in 2022 with the launch of HBO Max (now MAX) and Disney+, which attracted nearly 2 million new subscribers to global platforms. However, 2021 marked a pivotal year for Central European streaming services, initiating a wave of significant launches and strategic transformations aimed at better addressing the needs of local audiences.

One notable example is the Latvian service Tet+, which rebranded in March 2021 and captured a 35% market share by the end of the year. Similarly, in September 2021, Polsat revamped its offerings, introducing Polsat Box and Polsat Box Go, replacing the former ipla and Polsat Go services. This trend has continued into 2023, with local content owners recognizing the necessity of having a strong presence in the OTT market. RTL+ and TV2 Play Premium launched in Hungary, and Prima introduced its new OTT platform, Prima+, in Czechia earlier this year.

Local OTT services like Eon TV, Go3, and Voyo are experiencing faster growth than their global counterparts in the CEE markets. Go3, launched by regional broadcaster TV3 in December 2019, is on track to reach half a million subscribers this year. In contrast, Netflix and Amazon Prime combined had just over 200,000 subscribers across three countries at the end of last year. Go3’s success is largely attributed to its focus on local content and affordable pricing, with a basic plan costing €3.99 per month compared to Netflix’s €7.99 per month in the Baltics.

This shift towards OTT is also influencing legacy TV operators’ technological choices and market positioning. Satellite TV platforms are transitioning to fully IP-based and OTT services, such as Polsat, Canal+, and Orange in Poland, Skylink in Czechia and Slovakia, and Digi in Romania. United Group is gradually replacing its legacy technologies with the rollout of Eon TV in the Balkans. Meanwhile, PPF Group is introducing Yettel TV in Hungary, Serbia, and Bulgaria, leveraging Telenor’s former footprint.

OTT technology offers a cost-efficient alternative, allowing operators to provide more affordable services to their customers while staying competitive in a market reshaped by global streamers. This transition aligns with the broader market dynamics, enabling operators to offer a more modern and flexible viewing experience.

Interestingly, Central European OTT platforms are largely bypassing the ad-supported model, focusing instead on subscription-based services. For instance, Voyo transitioned from an ad-supported model to a subscription-based platform at the start of 2021. This strategic shift followed significant investments in content since PPF Group acquired the platform in 2020. As a result, Voyo’s subscriber base grew by over 60% within a year, reaching 570,000 in Czechia and Slovakia by mid-2023.

Polsat also decided to close its ad-funded streaming service, Polsat Go, in August 2023, pivoting to its subscription-based service, Polsat Box Go, launched in September 2021. The primary reason for this preference is the relatively low revenue generated by digital advertising. While advertising OTT revenues are projected to grow by an average of 32% annually between 2020 and 2025, subscription OTT revenues are expected to generate 57% more value each year over the same period.

Local streaming platforms understand that their content costs are unlikely to be offset by local digital advertising revenues alone. Subscription-based models offer a stable and predictable revenue stream, whereas ad-supported revenues can be volatile, especially given the disruptions in ad markets during the pandemic.

In regions where ad-supported models have thrived, audiences are often drawn by the prospect of free content. This is particularly true in markets like the US, where cutting the cord on traditional TV can significantly reduce household expenses. However, in CEE markets, TV access has historically been inexpensive, with well-established free-to-air options and competitively priced local OTT services, making free offers less attractive.

As new service launches continue to be announced, such as Pluto TV and BBC Player in Poland or Cosmote TV Go in Romania, the OTT market in the region is expected to keep expanding. However, saturation is becoming a concern, as seen in some advanced markets like Poland.

By 2025, OTT revenues in Central and Eastern Europe (excluding Russia) are projected to reach an annual value of €3.3 billion, with subscriptions accounting for more than two-thirds of the market value. This growth underscores the region’s potential and the evolving strategies of local OTT platforms to maintain their competitive edge in an increasingly crowded market.