Since 2022, changes have been brewing in the way sports broadcasters conduct business, so they are facing the challenge of attracting audiences in a context where public channels have modest transmission rights, but where also platforms, social networks, and even Connected devices are achieving unthinkable exclusivity agreements in sports, something unusual in the segment.

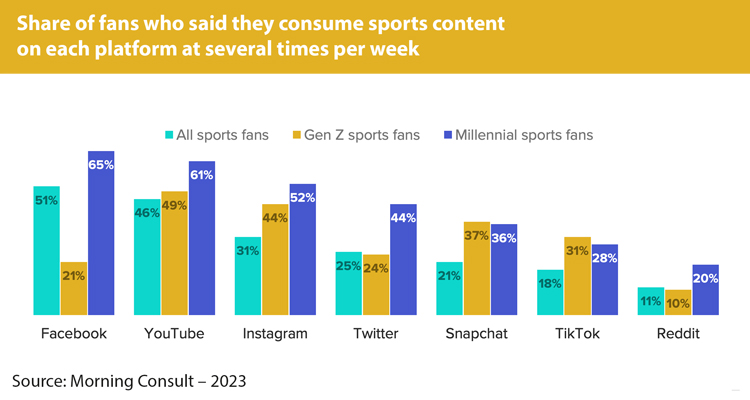

But in addition, the boom in digital transmission has made changes in the consumption habits of younger generations. Morning Consult reported in 2022 that the millennial fan base is avid consumers of sports content on different platforms during the week, surpassing even Generation Z audience. Now the question is how can content stand out in this increasingly competitive environment for eyeballs?

That is why there are already players in the media industry who understand these forms of consumption and are delivering content specially designed for these audiences, such is the case of OneFootball, the German-based soccer platform that gained popularity after acquiring video forum Dugout, thereby broadcasting rights of European clubs such as Real Madrid, PSG, Barca, Juventus, Chelsea or Bayern, among others. ‘OneFootball offers a platform for all content creators and content owners in the football ecosystem to connect with the fan base,’ said Yannick Ramcke, head of OTT, recently on a conference market.

Changes in consumption habits and audience retention

This social media and sports trend has caught the attention of large broadcasters, and it is not a mystery. According to Forbes, 4.9 billion people currently use social media worldwide, and this number is expected to increase to 5.85 billion by 2027. This is why social media consumption and demand for content will surpass the need for traditional broadcasting, so both models must work in unison.

One recent example is Sky Sports Germany, who expanded and diversified their Super Cup coverage last year by natively streaming 9:16 coverage from their live production system to the TikTok platform. The network even created additional content, such as “Watch Parties,” which brought together soccer experts, sports influencers, and attracted thousands of new audience members without adding any new technology to make it happen.

Another digital player that is making great strides in the sports segment is YouTube EMEA, who has made alliances with sports providers to bring primetime channels to both pay TV operators and its native platform in Europe. Some of the recent partnerships were with ARD+ (Germany), Sport1 (Germany), or directly with the European League of Football. These associations have made the streamer one of the strongest competitors in sports broadcasting in Europe.

This trend of digital events will continue to grow, according to Deloitte, who recently reported that the “blended realities” of Millennials and Generation Z in their constant engagement with the online world is generating great opportunities for the TV industry, due to their easy adoption. The report finds that younger generations’ digital experiences are characterized by a desire for entertainment, immersion and connection, making watch parties a smart approach to engage and excite this audience.

Pilgrim reported that YouTube is seeing an increase in the number of people watching its content from home, and in 2024, the platform will focus on better serving users watching in their living rooms. In his presentation at the latest briefing for DPP leaders, the head of sports and primetime channels, shared that viewers who tune in from the living room spend an average of 62 minutes consuming videos, which is more time than those who tune in. They watch from mobile devices.

Technology applied to sports broadcasting

Almost four out of five sports executives (79 per cent) believe automated content creation will impact their business significantly, 61 per cent believe remote production technology will be just as game-changing, according to the latest installment of Altman Solon’s 2023 Global Sports Survey. The survey of over 150 global sports executives and 2,500 consumers across eight countries spotlights how enabling technologies empower the value chain to generate greater fan engagement and unlock untapped revenue streams.

New technologies, including AI capabilities, virtual production tooling, and cloud-based workflows, are transforming content production and distribution in the sports media industry. In addition to the impact of content automation and remote technology, 74 per cent cite impactful changes from content localization, like Virtual Board Replacement (VBR). These drive cost efficiencies that drastically streamline content workflows and generate monetization. As media production and distribution workflows move to the cloud, rights holders and their media rights licenses will have greater opportunities to include localized highlight packages and acquire new, hyper-local advertisers with a fully tailored advertising inventory.

But how can this be planned for the 2024 sporting events? Take, for example, the Olympic Games; Next year, not only will surfers and skaters continue to compete, but also sport climbers. Climbing has enjoyed a wave of popularity among young people in recent years, and sports broadcasters can make the most of this surge in interest and attract younger viewers to their Olympic coverage.

Potential audiences can be reached before and after the Paris games, creating additional content, detailed explanations of the plays, and new content created through new production tools, including live streaming with sets created by artificial intelligence.