Sports broadcasting appear to be the next big frontier that will take on traditional TV and streaming. This idea has been on the table since cable cuts became massive in the USA, and sports rights began to be granted for the first time to a good portion of digital players.

Last year, Warner Bros. Discovery hinted that it is planning to launch a sports section on its Max streaming service under the Bleacher Report brand, and Disney is also seeking strategic partners to offer the ESPN cable network as a subscription streaming option in the future. .

For their part, tech giants Apple, Amazon and Google’s YouTube, along with Disney, are already closing deals for the rights to broadcast local NBA games and other sports. One of the first to achieve this was YouTube, who bought the rights to NFL Sunday Ticket starting with the 2023/2024 season. Amazon streamed Thursday night football games last year and Apple struck deals with Major League Baseball and Major League Soccer.

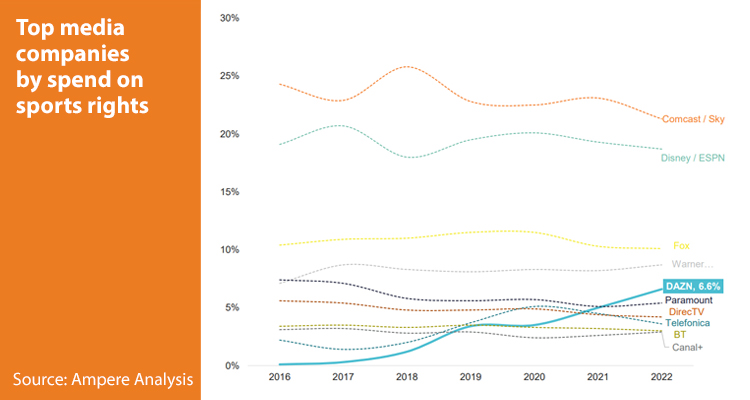

This interest on the part of these content generators comes at a time when traditional linear television revenues are falling, particularly due to the fall in advertising money. And while live sports broadcasts remain among the most-watched programs on television, media companies are increasingly considering streaming as their next step and are likely hoping that a shift toward connected TV (CTV) ad spending can offset the falls on linear television.

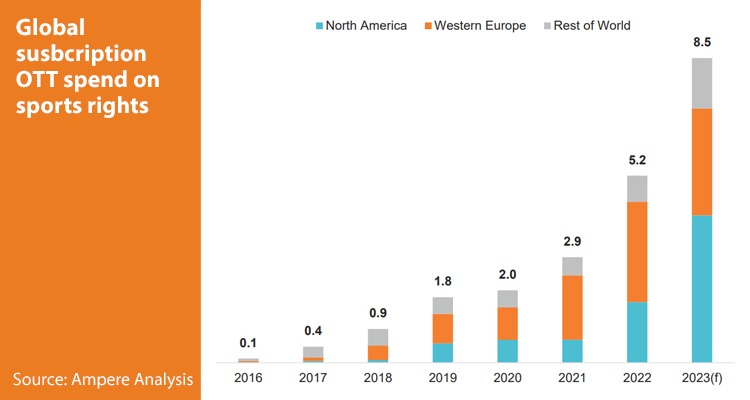

From Ampere Analysis, Jack Genovese, commented in a recent report: «in the coming years, subscription-based OTT services will account for more than a fifth of total sports rights spending in the worlds largest sports markets.»

It seems that one that has stayed away from this trend is Netflix, which has shown no signs of entering this segment, beyond talks it had last year to live stream a celebrity golf tournament.

This trend is strongly supported by advertising revenue. According to Insider Intelligence, CTV ad spends in the U.S. has increased nearly 400 percent since 2019 and will continue to grow substantially as linear TV ad spends growth slows.

And just as consumer preferences are also changing when it comes to sports, Ampere Analysis said 15,000 sports fans around the world ages 18 to 64 found that 37 percent only wanted to watch sports through a streaming service, while 21 percent preferred traditional broadcast networks (the remaining 42 percent were indifferent). ).

‘Cable packages are also being interrupted by the decline in subscriptions to sports channels,’ Genovese commented. As anxiety over linear TV grows, «spending on sports rights via subscription to OTT [over-the-top] platforms is set to grow in the coming years,» he added.

One of the great points in favor of streaming over sports rights is the strong engagement that fans usually make with brands, and advertising wants to take advantage of that dynamic.