Television in the US continues to evolve and transform, particularly in the linear and traditional business sectors, maintaining a relevance that allows it to compete in a landscape where streaming and digital consumption seem to dominate.

According to consultancy firm Statista, by the end of 2024, U.S. adults are projected to spend an average of nearly three hours watching traditional TV daily. This figure has been declining in recent years, and this trend is expected to continue in the coming years, with the exception of 2020 when media consumption spiked due to the COVID-19 pandemic.

However, the decrease in traditional TV viewership does not necessarily mean that people are spending less time in front of screens. Traditional players are adapting to this shift by entering the FAST (free ad-supported streaming) and AVOD (ad-supported video on demand) markets. Many are focusing on specific content segments, such as live events, including sports, concerts, news, and even disruptive content like eSports broadcasting.

In a recent interview, Jeff Shell, former CEO of NBCUniversal, acknowledged that while linear TV has been in decline for several years, it remains a profitable business for traditional media companies. One of the ways they have managed to stay relevant is by developing new business models, such as direct-to-consumer services.

A key example of this adaptation is in sports broadcasting deals. The NBA recently signed two new 11-year agreements with NBC/Peacock and Amazon Prime Video. These deals allow the NBA to leverage NBC’s strong presence in traditional TV alongside Prime Video’s vast user base in the U.S., which stands at 115 million according to CEO Andy Jassy.

On the other hand, some local TV stations have faced significant financial challenges, highlighting changes in sports content consumption. Last year, AT&T SportsNet exited the regional sports network (RSN) business, while Diamond Sports Group, the largest RSN operator, transitioned to a model that combines local TV stations with a direct-to-consumer offering. This shift reflects the increasing use of digital antennas and the rise of NextGen TV, while live sports streaming continues to grow as a cable alternative.

Traditional TV operators adapting to a linear experience with streaming

Traditional TV players are also entering the streaming market to provide more options for their audiences. Several business models, such as bundles or multi-aggregators, are gaining traction, especially among cable operators and telcos, helping them revitalize their businesses. Additionally, the AVOD and FAST models, both ad-supported, are offering distinct approaches to meet consumer demand.

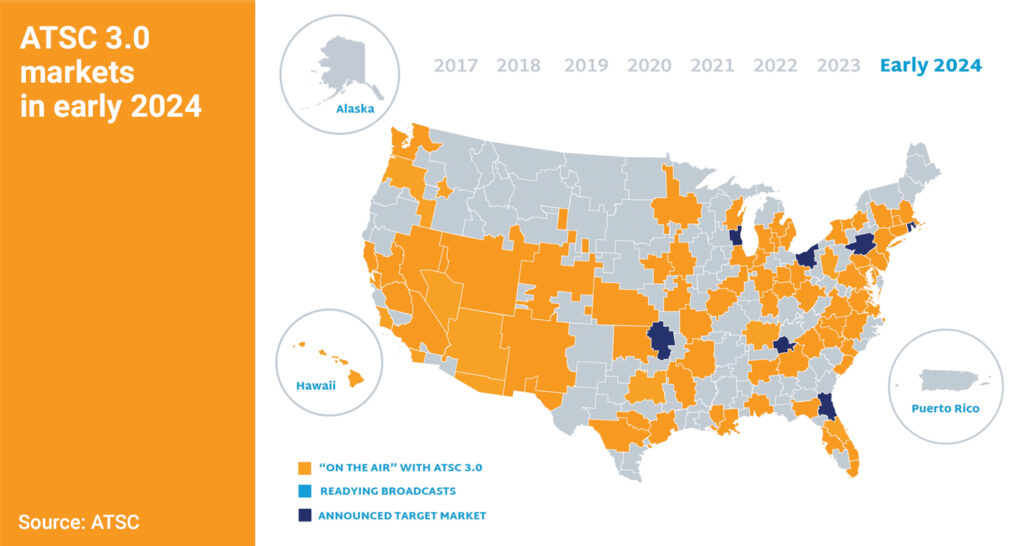

One significant technological advancement is NEXTGEN TV. This ATSC 3.0 standard is a transformative framework that combines modern broadcast TV functionality with robust internet protocol (IP) capabilities. It promises benefits such as 4K/HDR picture quality, enhanced audio, content interactivity, targeted advertising, and improved emergency alert systems. It also opens the door to post-TV industrial applications and new commercial data opportunities.

The Advanced Television Systems Committee (ATSC) projects that NEXTGEN TV could reach 75% of U.S. households, as more manufacturers like Sony, LG, and TCL adopt the technology. Consumers need an in-home antenna, a NEXTGEN TV-compatible television, and either Wi-Fi or a streaming subscription to access this service.

NEXTGEN TV is restoring advertisers’ trust in traditional TV by offering new ways to monetize content and recover lost advertising revenue. It also provides additional benefits such as multiple video streams, on-screen interactive apps, and the potential for mobile and in-car video content. Currently, 12,000 NEXTGEN TV sets are sold each day in the U.S., indicating a strong demand for this next-generation technology.