By Laura Tapias, VP America & Spain, Applicaster

While some attention continues to be dedicated to the growth of Netflix, Disney+, who recently announced the addition of AVOD to its offering, and other popular subscription VoD services, the market for free ad-supported streaming (FAST) TV services is expanding tremendously. Check the most updated data & figures of this amazing business segment: is FAST the perfect cure for subscriber fatigue or only the natural evolution of traditional commercial TV?

The FAST market in the US is poised to reach 216 million monthly active users in 2023, according to a new study from nScreenMedia. Europe is joining the shift to FAST and AVOD with the challenge and need to provide a multi-language offering opposite to the US, where it is mainly bilingual.

nScreenMedia also expects average viewing time per MAU to rise 27% from 2021 to 2023, to reach a «still modest» 13 minutes per day, which translates to an average of watching a full movie per week.

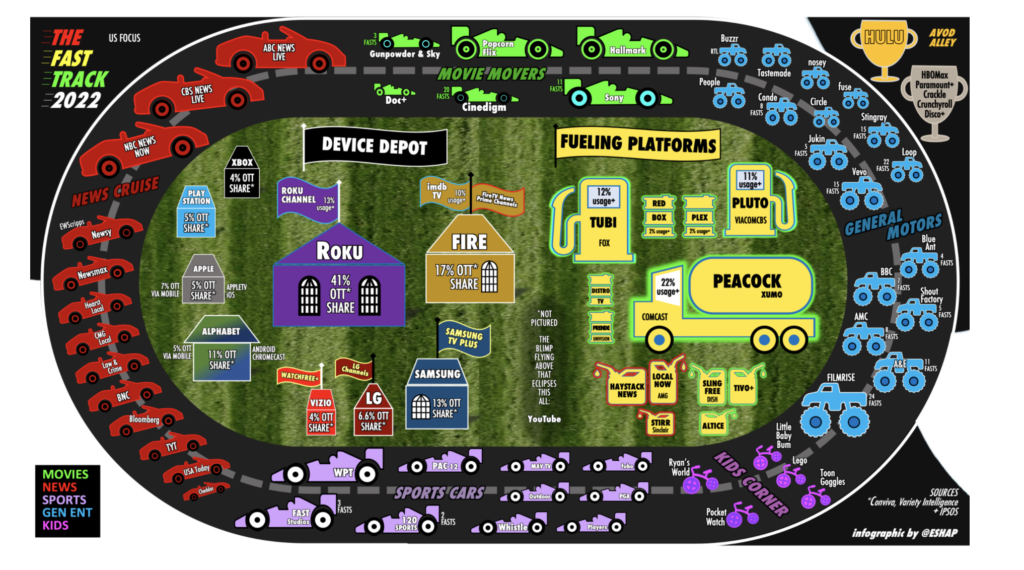

Distributors, programmers and device makers are all fully engaged and dedicating their efforts in building a strategy based in FAST. US media giants such as Comcast that acquired Xumo in 2020, Paramount launched Pluto TV (acquired by Viacom in 2019 for $340 million), and Fox Corp. with Tubi, the FAST service that snapped up, making the pay-TV market struggle in 2020. And 2021 had been the year where FAST boomed worldwide, with Pluto and Rakuten reigning the European market. Rakuten just launched 21 new FAST TV channels last year as a plan of launching a total of 90 pan-European FAST channels.

Platforms and devices are “queens” ruling content distribution, and racing to win first places in the ad-based field, sometimes competing between themselves as platforms need a multi-device distribution.

Roku business is largely driven by advertising – RAF– and FAST services such as The Roku Channel, which has grown dramatically in recent years. Many device makers have watched Roku reinvent its business and are working to do the same. LG, TCL, Vizio and Samsung, are becoming a force in the FAST game as part of a strategy focused on driving product sales and using ad revenues to bump up thinning product margins.

Content discovery and audience engagement

There is no doubt that the infrastructure for launching a FAST platform takes significant investment, but once launched adding brand extension channels is much simpler than in traditional TV. Streamers can launch as many channels as they like about whatever content they like. FAST also skips the complexity of dealing with payments or cable authentication, so these TV channels can be distributed to as many platforms they want, because setting up a channel is not more than a click in their backend.

Viewers today are finding a chaotic scenario, with mixed programming, extremely high ad repetition and very little usable on-channel promotion. So, 2022 looks like it will be the year of placing some order, and reactivating the expert programmers to run all these new channels and make them grow.

The FAST is a linear 24/7 programming schedule. Back to my time running a traditional TV channel, my mornings were based on deciding counterprogramming as per the data the audience’s team was providing daily. Audiences were based on average numbers, same numbers shared through all TV channel owners. In streaming the number of users are absolute numbers, that leads streaming owners to a blind sprint as it is difficult to access the competitor’s real numbers, due each platform and device have their own data stack. And depending on which back-end service providers you use; you get varying levels of detail from them. Each individual channel keeps its own data and controls the data they share with advertisers, but there is no unified source, turning counterprogramming a big challenge.

Serious programmers will force their channels to grow up, making major investments in programming and TV channel promotion, and probably the smaller ones will fade away. The advantage is that streaming brings a ton of new tools to grow and maintain growth such as personalization through AI placed on top of user consumption and behavioral analytics.

FAST programmers work will not only compete for streaming content prime time, also for the right user experience to grant TV channel discovery and user retention. Same way we are used in subscription VOD streaming services implementing changes in the order of the VOD content we see through our profile based on what content we are watching, the UX will equally update showing the FAST channels closer to our consumption habits. FAST aggregators are bringing the beauty of the traditional programming of a linear TV channel together with the UX and recommendations personalized based on audience/user behavior learning.

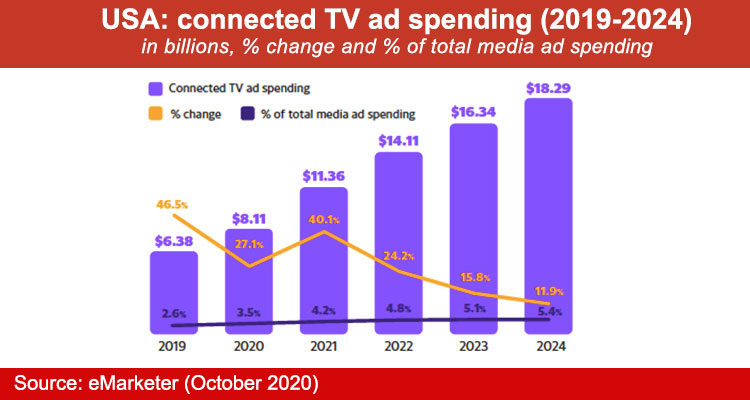

There is also work to increase advertising targeting and effectiveness with advanced data and unique inventory across all devices and platforms.

Advertising businesses have fantastic economies of scale and that’s one of the key advantages, but is also one of the key barriers to entry because it’s difficult to do this at a smaller scale. Commercially, when you have more scale, you have both more impact and more interest from advertisers. FAST aggregators are the ones to get higher monetization for each viewer. And by getting higher monetization, they’ll be able to invest more in better content, creating a virtuous cycle, which is difficult for smaller companies to enter.

Managing the advertising insertion in a linear channel is completely different from AVOD, and in a FAST aggregation it is crucial to provide a good user experience in all the channels, due bundle can play a role of customers not coming back to the other channels if they get a bad experience in one of them. So, building and nurturing loyal audiences and delighting new users across FAST TV channels becomes a massive responsibility.

Free only or a combination of free and pay?

TV operating systems and platforms are integrating FAST channels, changing their offering and UX, as it provides quick scale and are new distribution opportunities for content owners.

It might seem that free streaming services typically don’t have as many viewing quality options as their paid counterparts, and most make you watch a few ads along the way. But they’re starting to include original programming, or acquire libraries; as the Roku Channel acquired the rights to dozens of shows that originally appeared on the ill-fated Quibi streaming service, for example.

Traditionally, distribution windows were Pay TV followed by Free TV. And it didn’t mean that Pay TV had a better offering than Free TV. Today the streaming services can combine both (pay and free) on the same platform and even at the same time. ViX and ViX+, Peacock or Rakuten are examples of platforms that offer both (pay and free ad-based) from day one, granting a higher number of user acquisition becoming a relay race where the baton is passed quickly to marketing to convert these users to subscribers.

#1 Netflix has been opposed to advertising because it doesn’t want to be involved in privacy issues or have to spend money to track its subscribers’ locations, although Michael Natahanson suggested Netflix to change its tune in order to increase its growth, due the fast growth of ad-supported video estimating AVOD ad revenue to increase to more than $21 billion by 2025, when has grown from $1 billion to $5 billion from 2017 to 2020.

Also, Sports will end up embracing FAST. Till today, Sports had been used to attract new users to premium tiers. NBCUniversal’s Peacock and Paramount+use sports strategically to attract signups. Wouldn’t it be nicer to go back to the era of watching sports for free as we were used to in the traditional broadcasting and pull the creativity of the sponsors and advertisers to bring their best as is happening during the Superbowl in the US? Wouldn’t it be cool to have a super aggregator of sports? Wouldn’t it be a beautiful real estate for sponsored content categories? Looks like Tennis channel is the first to take the lead, launching its FAST in Samsung TV. Platforms are getting ready, now advertisers need to be ready to shift its weight to FAST too.

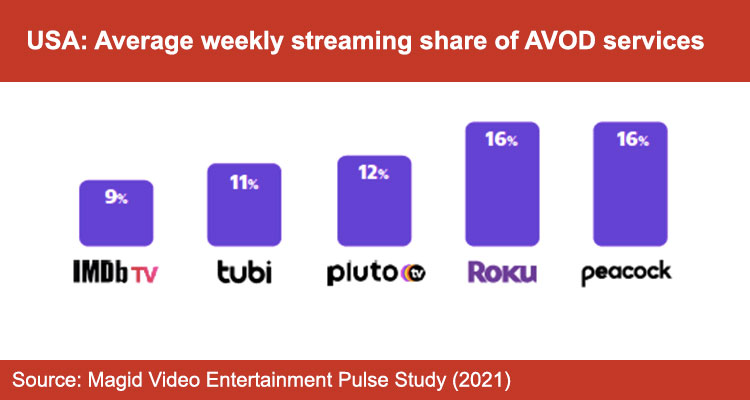

FAST only or FAST and AVOD

A question floating around the industry is can FAST and AVOD sit nicely next to each other? Rakuten TV and Filmzie are confident the two services can co-exist and are complementary. Particularly with the whole decision fatigue around so many different services to choose from. The beauty of this new streaming era is the possibility of offering both, live and on demand, for the user to choose what experience they want: just turning something on, or searching for what they want to watch. Viewers are already used to flicking on the TV and having it all shown there.

Europe might be trailing behind slightly, but the team at Pluto TV, which launched in Europe already three years ago, attends the European FAST market as the US. What created the boom in the US was the penetration of connected TVs. America is more advanced in its scale and size, but Europe goes the same way.

Local – Glocal – Local

Samsung is ramping up efforts to stream local TV news across its ad-supported branded “TV Plus” platform, which reaches 23 countries and more than 106 million devices globally. In a recent survey conducted by YouGov on behalf of the South Korean consumer electronics giant, respondents confirmed that TV viewing across the U.S. remains overwhelmingly strong, with local news leading the pack with 62%, followed by national/political (55%) and international news programming (24%). But not only news are the main local content reigning FAST, BBC just launched BBC Travel, BBC History, BBC Drama, BBC Doctor Who on the Samsung TV Plus platform across four European countries, followed by the roll-out of these channels on Pluto TV all with local language soundtrack available.

With the exception of news, rest of the content can be offered in local languages as Netflix did an amazing job having viewers already used to consuming original content in its original language, opening local content to the world and making international distribution easier.

Bottom line, platforms need to bring simplicity, and focus on distribution. FAST is an integrated business model that brings together advertisers, platforms and devices and content owners. The right distribution strategy together with branded marketing to raise awareness of the service, will make a big difference in your FAST channel success. Streaming distribution is directly managed by platform operators, we only need to see if FAST will provoke the same effect that SVOD has done to traditional Pay TV.