The African OTT market is one that has been growing substantially for some years now. Digital TV Research forecasts that the continent will have 15.57 million paying SVOD subscriptions by 2028, up from 6.15 million at end-2022.

This trend is accompanied by the strong penetration of the domestic internet, however, the consultant that this rate will remain low, with only 7% of TV households paying for a least one subscription by 2028.

In MENA alone, there are already about 516 million internet users (higher per capita than global internet penetration, according to eMarketer), and year-on-year growth between 2.9% and 4% through 2026 is also projected.

Some consultants have even predicted that only 6.6% of TV households will pay for at least one subscription by 2027, up from 3.9% at end-2022.

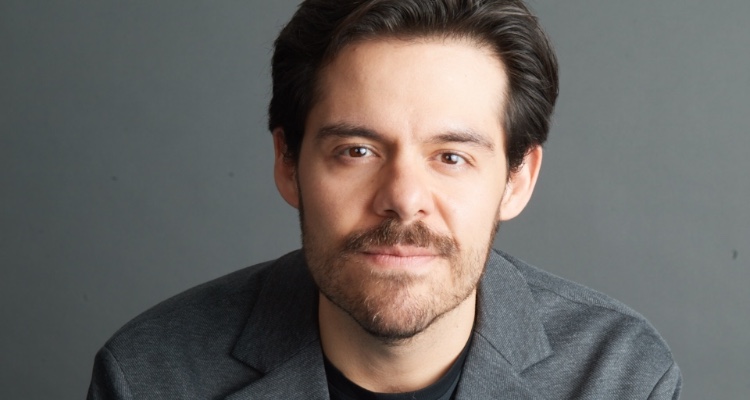

Simon Murray, Principal Analyst at Digital TV Research, recently said: ‘Take-up is inhibited by low disposable incomes. Limited fixed broadband penetration also stifles growth, with few mobile operators offering OTT options. Not all global SVOD platforms will start in every African country – restricting choice’.

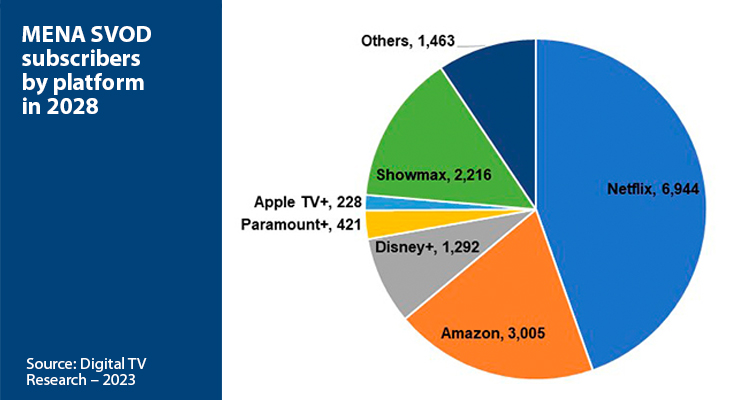

The firm thnks that Netflix will generate 6.94 milllion by 2028, 45% of the region’s total. In addition, Dinsey+ will count 1.29 millions subscriptions by 2028 too, with a rollo-out in other territories like Nigeria and South Africa. While Paramount+ is only likely to start in South Africa. HBO has a distribution deal with Showmax.

Countries on focus

This reflects the enormous demand for digital content in this region. Recent research from GWI and eMarketer attest to this trend. In Egypt, digital video is adding more viewers than live broadcasting TV. Just in the first half of 2021, 92.1% of internet users streamed some content in SVOD.

Meanwhile, the consultants also highlighted the Saudi Arabian market, where the majority of internet users, just over 95%, watched videos on the internet in 2021; this figure being higher than those who spent time watching open TV, 91%. They also highlighted that in this territory, internet users are consuming at least two hours a day of streaming content.

Israel was another of the countries in which the consultants focused. Here, live broadcasting television still sees more of consumers’ time spent, however, digital video also had substantial growth last year. “ of 3 internet users in this country told pollsters that they would use SVOD services in 2021, up from 61.2% in the year prior.

UAE was another of the analyzed markets, where they found that video consumption has been higher than that of traditional TV, with a greater percentage of internet users watching streaming over broadcast–95.4% vs. 86.1% respectively.

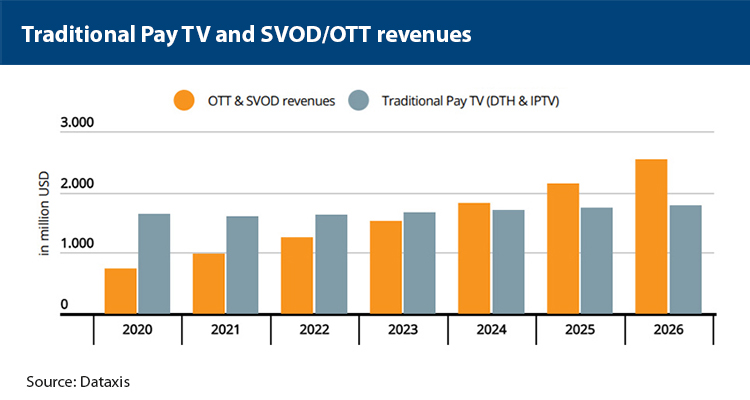

Covering other countries, Media Partners Asia (MPA) recently reported that the countries that make up the Gulf Cooperation Council (GCC) (Bahrain, Kuwait, Oman, Qatar, the Kingdom of Saudi Arabia and the United Arab Emirates) showed growth in revenues by 11%. year on year by the end of 2021, in the media, content and TV segment. In 2021, SVOD contributed 23% to total GCC video industry revenues while AVOD contributed 26%, bolstered by global majors YouTube, Facebook and Snap. Total online video revenues are projected to grow at a CAGR of 7% to reach US$1.4 billion by 2026 with SVOD contributing 31% and advertising, 34%.

Regarding this report, MPA Vice President Aravind Venugopal said: ‘During 2021, some of the momentum from COVID-19 which accelerated the adoption of online services, started to taper. While subscriber additions decelerated during 2021 as Covid-related restrictions eased, an increased content pipeline for SVOD platforms resulted in flat to marginal subscriber growth for most operators’.

Market drivers

These numbers are driven by the penetration of streaming platforms and heavy investment in local language content, which has started to scale in several MENA countries.

Several SVOD players, who initially entered the market through alliances with local TV Networks, are now considering offering their services under the direct-to-consumer model. An example of this is Disney+, whose originals have been distributed by OSN in the region from 2020 until this year, when the platform landed in 16 MENA markets. Likewise, the efforts to enter this territory also go hand in hand with partnership strategies implemented with telecommunications operators.

In terms of local content, MBC‘s platform Shahid and Viu lead as the largest producers of Arabic originals, having produced between 25 and 30 originals since its launch. As for Netflix, despite its slow penetration, has begun to order local original productions for subscribers in this market, the most recent being the Jordanian series Al Rawabi School for Girls. In addition, Starzplay secured $25 million in debt financing past year to support its content investments and strengthen its presence in MENA.

The truth is that as digital technology increases the share of entertainment revenue, media companies will continue to prioritize attracting more audiences with compelling local content and partnerships with international players with reach across devices.