The MENA region is becoming an increasingly attractive market for streaming and media companies, with subscription video-on-demand (SVOD) revenues expected to exceed $1.2 billion by the end of 2024. As digital penetration rises and consumer habits evolve, businesses are looking for ways to effectively reach and monetize this dynamic audience.

At the 2024 MENA Monetization Summit in Dubai, industry leaders explored key drivers of growth in the region and the strategies that have propelled streaming services to success.

Opportunities and challenges in the market

MENA’s young, tech-savvy population is fueling rapid expansion in digital entertainment, but reaching this audience requires a localized approach and a diverse content strategy. According to Omdia, key trends shaping the region include:

- The rise of online video advertising – Expected to grow 67% by 2028, outpacing traditional TV advertising.

- A shift towards hybrid monetization models – Many platforms are blending subscription-based and ad-supported content.

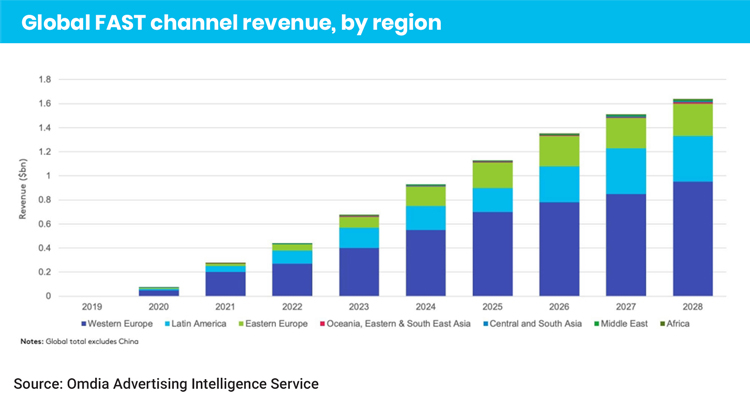

- A growing Free Ad-Supported TV (FAST) market – With revenues projected to quadruple in five years, FAST channels are emerging as a key alternative to pay-TV.

- Strong demand for sports content – Sports such as cricket, rugby, and mixed martial arts present major opportunities for streaming services, as they remain underserved by major players.

Local strategies: what’s driving success?

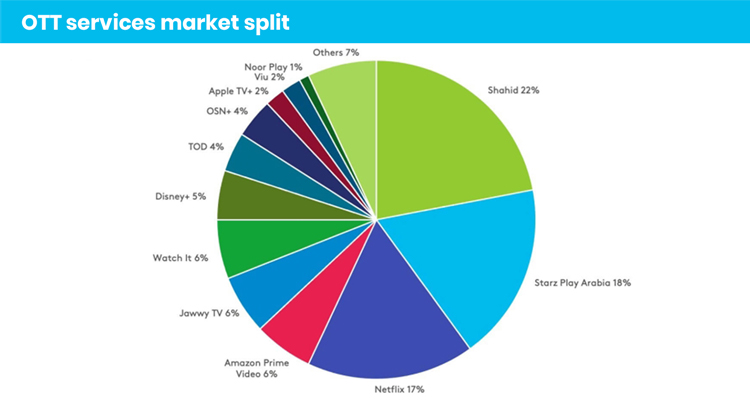

Leading platforms like STARZPLAY Arabia and Shahid have carved out significant market share by focusing on audience preferences and content localization. Together, they control 40% of the MENA streaming market, according to Q4 2023 data from Omdia.

- STARZPLAY has grown its user base to over 3.5 million subscribers by securing rights to high-demand sports like the UFC, Cricket World Cup, and ICC tournaments. Enhancing the user interface for sports fans has also been a key factor in engagement.

- Shahid, owned by MBC Group, has leveraged its extensive Arabic-language library to drive both ad-supported and subscription-based growth, with a particular focus on premium Arabic content.

Emerging trends and innovations

Media companies expanding into MENA are embracing new technologies and content strategies to enhance engagement. Some of the most promising trends include:

- AI-powered personalization – Streaming platforms are increasingly using artificial intelligence to analyze user behavior, improve content recommendations, and optimize advertising strategies. AI-driven automation, such as real-time language subtitling, is also helping to make content more accessible.

- Esports and niche sports expansion – As esports gain popularity in the region, streaming platforms are exploring partnerships to tap into younger, highly engaged audiences.

- Cloud-based infrastructure – With millions of users streaming simultaneously, investment in scalable cloud solutions is crucial for maintaining a seamless experience.

Key takeaways for market expansion

For businesses looking to establish a strong foothold in MENA’s streaming market, industry leaders recommend the following approaches:

- Capitalize on underserved content categories – Niche sports and locally relevant entertainment formats offer an opportunity to stand out in a competitive market.

- Build partnerships with regional telecom providers – Collaborating with telecom operators can expand reach and accessibility across mobile-first audiences.

- Invest in hybrid revenue models – A mix of subscriptions, advertising, and sponsorships will be essential for long-term monetization.

- Leverage AI and data analytics – Personalization is key to improving user retention and engagement, particularly for platforms offering both local and international content.