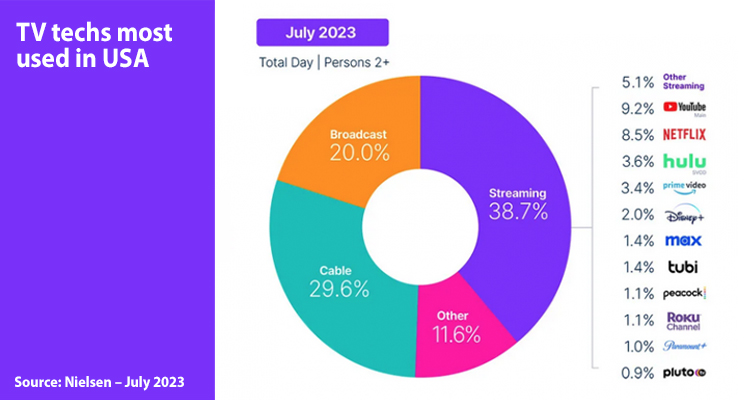

In July, streaming in the US reached a new high, causing broadcast and cable’s combined viewership to dip below 50% to 49.6%, reports Nielsen. Broadcast’s share hit a new low of 20%, down from 20.8% in June, while cable’s share fell to 29.6%, down from 30.6%.

Though overall TV usage saw a slight uptick of 0.2% from June, viewership among those under 18 rose by 4%, while adults 18 and older saw a 0.3% decline. This led to increased streaming and ‘other’ usage, largely attributed to video game consoles.

While new seasons of original shows hit streaming platforms, just the acquired ones was stood out. Suits on Netflix and Peacock, along with Bluey on Disney+, dominated last months, amassing a total of 23 billion viewing minutes.

For example, Suits set new records for acquired titles, garnering nearly 18 billion minutes. Overall, heavy viewing levels propelled streaming’s TV share to 38.7%, a new record, with Prime Video, Netflix, and YouTube all reaching all-time highs.

In comparison, broadcast sports generated almost 25 billion viewing minutes in July, spread across various channels. July is typically considered a slow month for sports, as viewership usually more than triples when September begins. Drama remained the most-watched category, capturing 25.7% of viewing. Total broadcast viewing dropped by 3.6% to end the month at 20%, marking a new low. Year over year, broadcast usage was down by 5.4%.

Cable viewing also declined, losing a full percentage point to capture 29.6% of TV in July. Feature films were the only genre to see a rise in viewership (0.5%), despite a 1.5% decrease in usage. ESPN’s Home Run Derby and the College World Series took the top two slots, followed by When Calls The Heart on The Hallmark Channel. On a year-over-year basis, cable usage was down by 12.5%.

The arrival of autumn is expected to bring a seasonal shift in TV viewing, especially with the new NFL season. Nielsen suggests that with potentially fewer new original primetime shows this fall, broadcast and cable may face a unique situation. However, the recent success of acquired programming on streaming platforms underscores the enduring strength of quality content, regardless of its creation date.

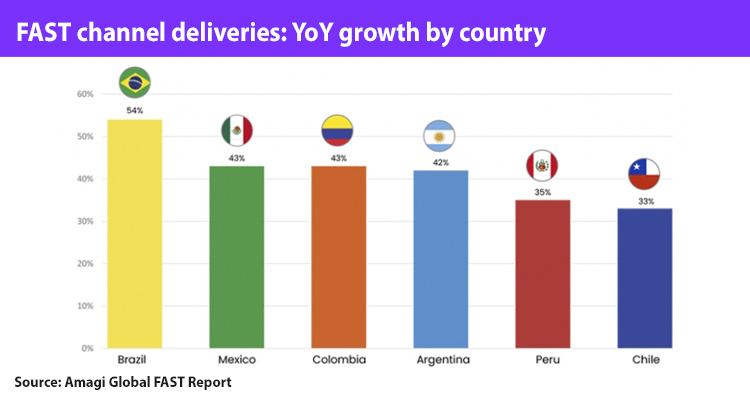

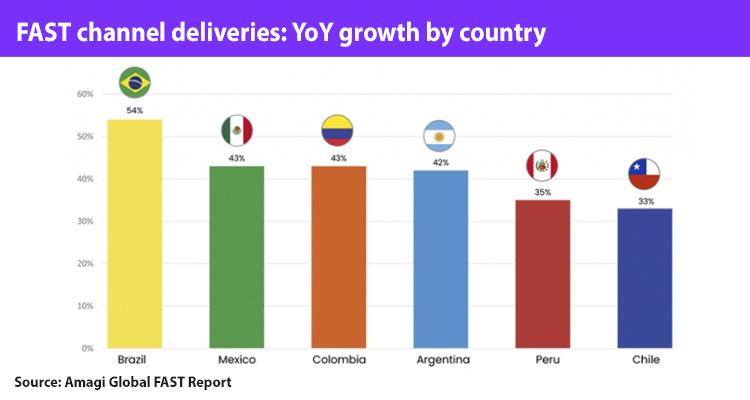

In Latin America, Intelsat believes that as the economy in the region recovers, investors and broadcasters see potential within the Pay TV segment. For example, satellite technology is driving significant multichannel potential, which linear TV could take advantage of. In Mexico, the Pay TV market grew by 3.2% in 2022, in addition to this, in Peru, cable service revenue is projected to increase by almost 10% in the coming years.

Even the growth of OTT in Latin America is actually improving pay TV market share, as the proliferation of AVOD streaming options is representing an opportunity, especially as many top-tier programmers include OTT services with TV subscriptions. existing pay to increase viewer retention.

As OTT and video streaming expand at the pace of the Latin American mobile market, there are more opportunities to combine newer services with pay TV and offer them more reliably at a lower cost via satellite. The upward trend is strong: in 2025, OTT will represent 9.7% of the pay TV market.

Due to this, in LatAm, AVOD continues to maintain its growth gap. Consulting company Magnite revealed in its recent report that 71% of current pay TV customers in Latin America do not mind switching to an ad-based streaming model and are willing to watch ads in exchange for free content. That’s because of the affordability and simpler interface.