According to Mediastream, the OTT segment is expected to reach USD 1.039 billion by 2027, attesting to a segment that will continue to grow as technology advances. On the other hand, Digital TV Research also ensures that the global revenues of these services will reach USD 243,000 million in 2028 and only in 2023 around USD 17,000 million will be added. This same report also indicates that by 2027, 1.690 million subscriptions will be added, and only six of them (Disney+, Netflix, Amazon, Paramount+, HBO and Apple TV) will concentrate 989 million connections.

From focus on data, to more personalized experiences, these are some of the innovations that streaming developers are testing and putting into practice on some platforms. In this report, Prensario reviews some of the trends that will govern the segment in the coming years and why it will be useful for decision makers.

Focus on data and personalization

One of the biggest advantages that streamers have, compared to traditional TV, is access to consumption data. Whether it is to develop smart strategies, increase customer retention or deliver personalized content, streamers take advantage of this information and also provide it to some advertisers (in the case of AVODs), to help to successfully position their brand.

‘The data is more than a trend. In an increasingly competitive OTT environment, smart data collection and analysis capabilities are power. How users interact with platforms and content is becoming critical for OTT providers to drive engagement, market share and monetization’, said Ido Hadari, CEO of Applicaster.

On the other hand, customization continues to gain strength, as platforms improve their interfaces. That is why in 2023, personalization will grow as data analysis tools become more sophisticated, and OTT service provider companies learn what motivates their viewers.

Salesforce and Amazon Web Services recently announced a viewer feedback and data analytics tool to help content distributors deliver more personalized experiences: ‘Together we are providing a suite of tools powered by Artificial Intelligence (AI) to further help studios, streamers and other distributors to quench consumers’ thirst for personalized content’, Christopher Dean, VP & GM, Media & Entertainment & Media Cloud, Salesforce.

Two business models, one platform

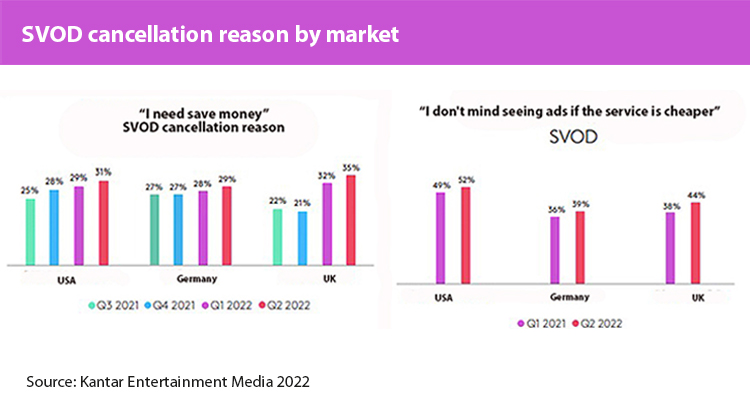

The saturation of the streaming market, the growing abandonment of streaming services, and the so-called fatigue of having several platforms at the same time, has made OTT companies rethink their D2C streaming models. That is why more and more VOD platforms are launching combined SVOD and AVOD offers in the same interface, an example of this: Peacock, ViX, RTVE Play, and recently Netflix and Disney+ in the USA.

‘Many broadcasters will develop multiple FAST channels and complementary streaming services to bundle multiple FAST channels and VOD together. Their strategy is to move their TV ad sales into the digital ad sales space,’ said Stephen Hodge, CEO of OTTera.

Sport as a premium offer

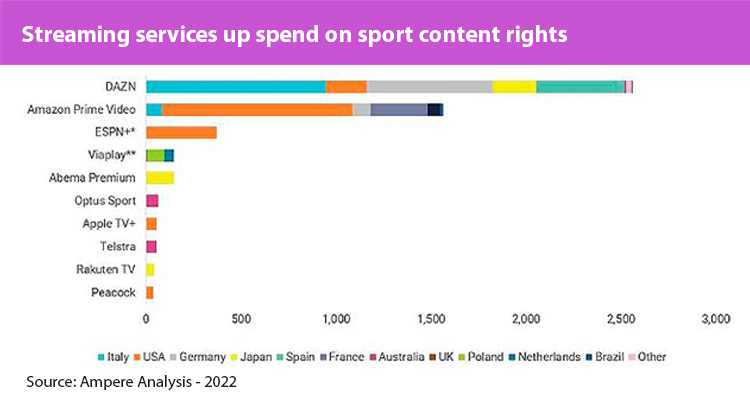

Sports streaming is undergoing a seismic shift as OTT platforms increasingly spend millions on live sports rights to attract and retain subscribers. 80% of UK sports fans now want to watch sport exclusively on streaming platforms, as pay-TV customers continue to decline in the market, according to the “2022 UK Sports Video Trends” report from cloud video platform Grabyo. In this sense, it is expected that the spending of subscription OTT services on sports rights worldwide this year will reach 8,500 million dollars.

Apple recently spent at least $2.5 billion for the exclusive rights to broadcast all Major League Soccer (MLS) games in that country over the next 10 years on Apple TV+. The agreement means that the matches of this competition can be followed through the MLS Season Pass in the Apple TV + application and will cover all global markets through different subscription plans.

DAZN was the one who led the way for the increasing investment of streaming platforms in sports rights. The service accounted for 54% of all subscription OTT service spend on sports rights in 2022.

While in APAC, Viacom18 acquired the domestic digital rights to Indian Premier League (IPL) cricket games in a five-year, $3 billion deal. In 2022, Singapore-based combat sports company OneChampionship signed a partnership with Amazon Prime Video to allow subscribers in the US and Canada to access 12 exclusive live annual events.

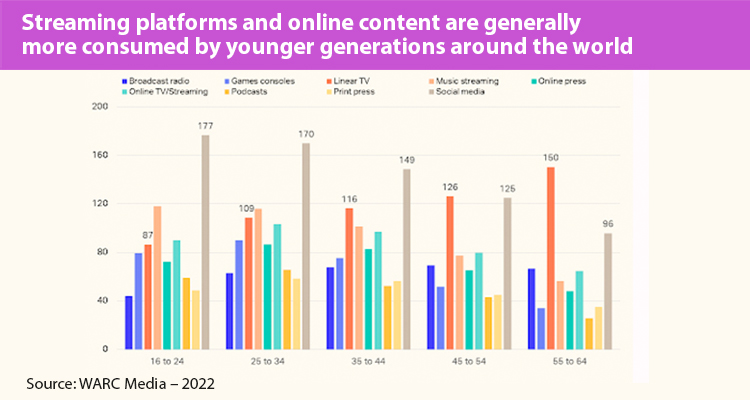

Generation Z and its influence on OTTs

Generation Z has become one of the most influential consumer forces today, both for its growing purchasing power and for its decision-making at home. Business Insider believes this group is surpassing Millennials as the largest generation alive, representing 40% of global consumers: 81% use social media, 33% don’t watch live or cable TV, and 73% watch OTT content on smartphones or tablets.

That’s why OTTs are putting together their strategies focused on generational changes to reach them, connecting with current trends, adopting cross-device strategies, and recommending more personalized content and advertising.

‘With the rise of Gen Z (and Gen Alpha right behind them) and new viewing habits, media companies need to figure out how to serve across all platforms and deliver content at the right time of day. This new generation is shaping the future of transmission’, said Oliver Gades, VP of Applicator.

Streaming platforms are turning to this group to develop new genres and technology in search of diversified content, and provide a competitive advantage. From association with video game companies, to content that interacts with this audience, are some of the strategies of today.

Such is the case of the association between Disney+ and Xbox, or Netflix with Ubisoft, even DAZN, which announced a ten-year agreement with the National Football League of the USA to carry its streaming platform, NFL Game Pass International (NFL GPI) around the world, starting in 2023.