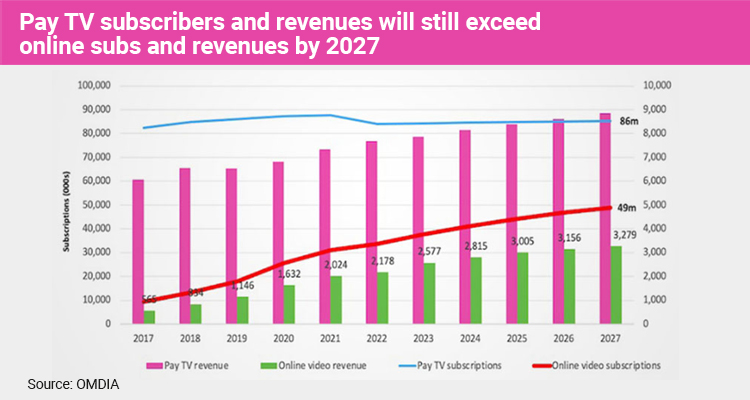

Reaching $8.8 billion by 2027, Pay TV is expected to continue to grow for years to come. This forecast is driven by the low penetration of the large streaming platforms and some distributors, who have highlighted the language and location barrier as one of the problems for operating there.

These data have recently been provided by OMDIA, who also highlighted that the number of subscribers will continue to exceed that of streaming services.

Another consultancy that has also agreed with these figures is Dataxis, who also reported that the revenue of pay TV, or premium TV, in this territory, was expected to reach nearly nine billion U.S. dollars in 2027, which would be 2.7 times more than the earnings of the online video industry. He also mentioned that the penetration rate of pay TV in the CEE region stood at 56 percent in 2022 and was expected to decrease only slightly in the following years until 2026.

Omdia also added that while streaming is a nascent market in CEE, Pay TV will far exceed the $3.3bn of online video, a segment that will remain with 86mn subscribers.

While global online video subscriptions have already surpassed pay-TV subscriptions, this is not the case in CEE, where the popularity of pay TV is expected to continue, revealed Maria Rua Aguete, Senior Director.

An important point is that while pay TV may be taking the lion’s share of the pie, subscribers will only grow 15% in this time. Meanwhile, traditional TV advertising is forecast to grow 5.8% over the next five years in CEE.

‘While in most countries online subscriptions have already overtaken pay-TV, in CEE pay-TV will continue to be the leader in 2027 over online broadcasts. Although in the next five years, most of the growth and new additions will occur in the online world,’ said the executive.

Broadband TV News CEE market analyst and editor Chris Dziadul commented on some recent insights regarding the Pay TV market in this region.

‘It is perhaps not surprising that the current state of the region’s pay-TV industry varies from country to country. New research published by the Atmedia agency points to the fact that, as of the second half of 2022, pay-TV adoption in the Czech Republic was still only around two-thirds that of neighboring Slovakia, i.e., 57% versus 95%. Viewers in the Czech Republic are affected by the number of terrestrial TV channels they can watch for free, so pay-TV penetration in the country remains low. However, it is likely that it will continue to grow, at least for the next few years’, said the expert.

‘Meanwhile, Slovakia belongs to the CEE group of countries where pay-TV penetration is already very high. They include Romania, where the cable is still king and IPTV, unlike the rest of Europe as a whole, is a secondary actor’, he also specified, in relation to the variations of other consultancies, such as Digital TV Research, where he reported in a recent publication, a decline of 8 million subscribers in the entire Pay TV market in CEE.

Dziadul also offered a curious fact, and that is that pay TV makes a positive contribution to the economies of many countries. He said that in Poland, for example, it represents 0.25% of GDP, according to a report by Arthur D. Little. ‘But significantly, this figure is only just behind the UK’s 0.26%’, he remarked.