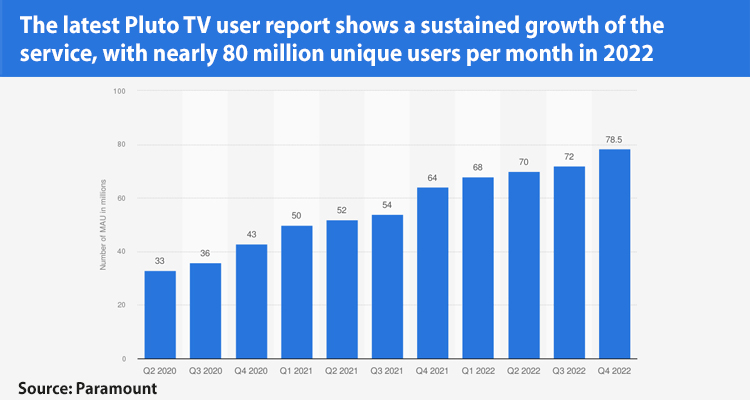

Paramount presented incredible growth numbers for Pluto TV earlier this year. Its AVOD/FAST platform registered 79 million monthly active users and more than 6.5 million new users in the 35 markets where it is available, being fundamental to this figure the growing strategic distribution alliances that the company has undertaken with the streamer.

At a recent conference, Olivier Jollet, Executive Vice President and International General Manager of Pluto TV, highlighted the extreme dedication that Paramount has to its AVOD, especially when it comes to launches in new markets.

‘The differential we have as a platform is when entering a new market, like the approach we have in distribution and content. This is because we analyze which will be the best partners for distribution, or how we analyze which is the content potential audience on some titles, that’s why we usually locate a local team to help us identify these factors. Even the marketing approach is very well thought out in Pluto TV’s strategy in these markets’, Jollet noted.

The exec defined Pluto TV‘s strategy in the world as ‘glocal’, and just reviewed the recent alliances, such as the most recent one, signed with TP Vision, the Netherlands-based subsidiary in charge of developing Phillips televisions, which the platform would reach homes in 25 markets where this brand’s smart TVs are distributed. Added to this is the alliance with Virgin Media whereby households with either the Virgin TV 360 or Stream products can now receive over 100 live linear channels from the service.

Global and local brand content

Framed within the strategy mentioned by Jollet, the content available on Pluto TV varies in each of the markets where it is available, so they apply different strategies. One of these is the extreme market analysis, carried out by the local Paramount team, which identifies needs, opportunities, and feasibility. After this, they study potential alliances, whether to supply a general program demand or, what they most apply, is to supply a very specific niche demand, but for free.

‘With Viaplay in the Nordic countries, it was the first time we presented ourselves with a joint strategy with a player so strong that it could be our competition, so they closed the platform by integrating everything within Pluto TV UX with a dedicated brand area. We replicated the same strategy last year in Canada with Chorus, where the company was the advertising representative, in addition, we offered a selected list of Corus Original library series spanning a variety of genres, beyond our 100+ channels’.

Apart from these two agreements, they signed with ZDF in Germany, with Mediawan in France, with Mediaset in Spain, and with El Tiempo in Colombia. In all of these, the user experience is one of the protagonists, since the integration of the platform and the partners is specially designed and branded in an attractive way for users in each of these markets.

But not everything is limited to partners that provide content, although Pluto TV does not produce original content, unlike its SVOD competition, it has signed exclusive deals for programs, as happened in Sweden, where they were the exclusive outlet for the last season of the reality show Paradise Hotel; or this year’s success in Argentina and Chile, Big Brother, where they offered a dedicated 24/7 channel, which received record viewership, attracting nearly 3 million unique users, only on the program’s channel. ‘It is an important achievement if we take into account that there are 19 million inhabitants in Chile alone’, the executive remarked.

Another segment that Pluto TV is building is sports content, and Jollet specified that they are acquiring exclusive rights for niche tournaments and competitions, to attract a more specific audience. With DANZ they achieved an alliance that covers Latin America, France, Germany, Denmark, Sweden, Norway, and Austria, where they already have 5 channels with sports programming. While in Latin America they acquired the exclusive digital rights to the Copa Libertadores Femenina competition.