| |

Prensario – Miami January Events 2024 – Wrap up in English Language

|

|

Miami January events: the absurd and the value, together

|

|

Miami has lived this January the same situation seen in Budapest last June: two events, NATPE GLOBAL and CONTENT AMERICAS (again) have organized two events at the same town in two weeks in a row. But, on the opposite from Hungary, where Natpe was good and Content small, and now the latter is announced for Warsaw, in America the two went from well to very well, with NATPE more focused on a global audience —the hit was to integrate the US domestic market with the US Hispanic and Latin head communities— and CA taking most of US Hispanic and Latin America + Iberia: Spain and Portugal. So, the absurd of doing many things twice and the good business value, have worked together in Florida.

|

|

|

The Latin Rose d’Or Awards, at Content Americas: Cris Morena (Argentina) received the ‘Trajectory’ Award, ‘All the flowers’ from Globo Brazil was the ‘Best Telenovela’, ‘El Encargado’ from Disney got ‘The Best Series’ award and ‘Noticia de un secuestro’ from Amazon/TIS, got the ‘Best Drama’ award |

|

|

|

|

|

|

|

|

The good value has been possible because the events were complimentary. NATPE provided worldwide distributors, the opportunity of accessing especially first and second tier buyers of the US ‘anglo’ market, who haven’t recently had a pure event for them. The original NATPE was their place years ago, when the US domestic market of regional and zonal TV stations was strong. But then there were progressive mergers and NATPE got international. Now, with the rise of many strong US 2nd tier VOD platforms, that market has appeared again. Players like Plex, Zone TV, Scripps, or state ones as NPD —New York— which has free TV and now OTT… the European, Turkish and Latin suppliers that have attended, said that want to do it again next year.

|

|

|

Brunico staff at the closing party of NATPE Global: Claire Macdonald, CEO NATPE, and Russell Goldstein, CEO Brunico, in the middle. The event was success integrating the US ‘anglo’ market with international |

|

|

| |

|

|

|

|

|

|

|

|

The CONTENT AMERICAS case has been not traditional either. With the collapse of original NATPE in 2023, it caught the plaza in January last year and was very good to keep it, attracting not only US Hispanic and Latin American members, but also Iberia —with the current power of the Spanish studios, production hubs for Europe and the Americas— and the Turkish community, this year with a glamorous ‘Turkish Drama Gala’ as a kick-off the previous evening. Based on these three pillars, the event was very intense, with people running in all directions, meetings back-to-back and many events and announcements.

|

|

|

The ‘Turkish Drama Gala’ at Content Americas: Gema López from organizer Universal Cinergia, Beatriz Cea Okan and Can Okan, both from Turkish distributor Inter Medya, Liliam Hernández form Universal Cinergia, with other participants at the ‘Red Carpet’. It was a glamorous party as in the Golden Years of the industry. |

|

|

|

|

|

|

|

|

So, CONTENT AMERICAS announced 2000 attendees, +150 exhibitors and about 1000 buyers. NATPE GLOBAL had fewer people —it informed 1500 attendees, +120 suppliers and +700 buyers— but better density of buyers with strong acquisition power. Everybody asks what will happen in the future, if the two markets will go on next year. Everyone too is against the two-events model, because it obliges many extra costs, time and efforts. Though, we must say that today, the most probable option is that the two events continue as this month. The two had good outcomes and considering the rivalry, they difficulty deal a solution as sharing the same week or a moving to another fall. NATPE based a portion of its booth sales this year in the debt that older NATPE had due to its fallen 2023 edition, but organizer Brunico stresses to be very happy with his experience.

|

|

|

The ‘Super CCO Panel en Español’, top panel at Natpe Global: Mariano Cesar, head of general entertainment content, LatAm & US Hispanic, Warner Bros. Discovery; Ronald Day, president, entertainment & content strategy, NBCUniversal Telemundo Enterprises; Vincenzo Gratteri, SVP content development, ViX, Televisa Univision; Francisco Morales, head of content strategy and acquisitions, LatAm, Amazon; Nicolas Smirnoff, director de Prensario International |

| |

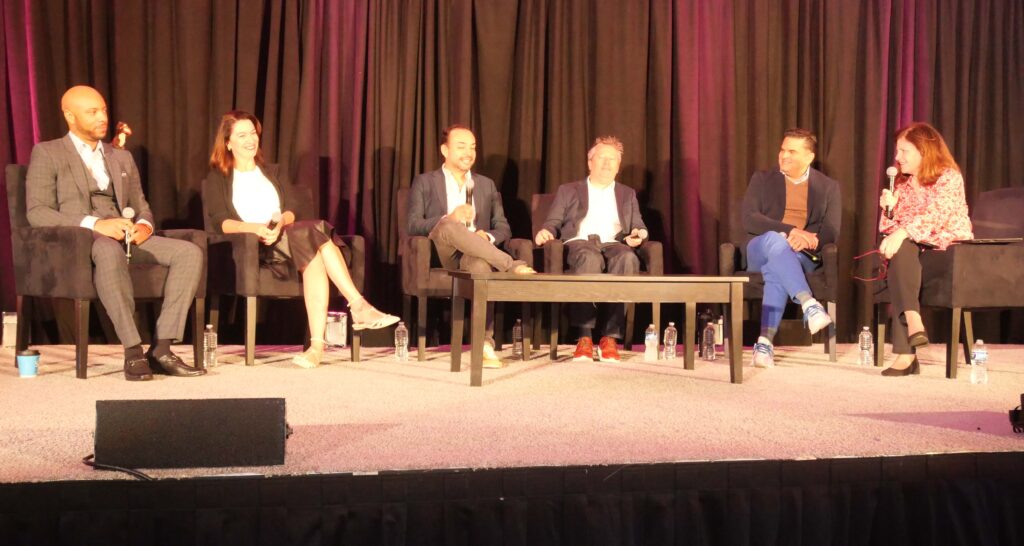

A big FAST panel at Content Americas: Stephen Hodge, CEO OTTera, Aline Jabbour, Samsung TV Plus, Felipe Rey, Head of M&E partnerships, Google TV, Richard Young, Little Dot, Eddy Arias, VP International, Content Partnership, Pluto TV (Paramount) |

|

|

|

|

|

|

|

|

|

|

Market trends? Major US studios has continued the opening of international distribution. Disney added this month to third party sales a dozen of new hit titles, from classic ‘Beaty and the Best’ to recent ‘Cruella’, ‘Mulan’ and ‘Zootopia’. WBD is operating now with three commercial levels: the exclusive product for Max —the original series and the top theatrical releases— the co-exclusive content with just one partner —recent hits— and the rest with already multiple windows. MGM Amazon has not added new titles from October to the 48 Amazon originals opened to others, but has improved the sales very much. Sales trends? The original series are demanded mainly by other VOD platforms, while the feature films are requested by free TV channels.

|

|

|

The US domestic market present, at Natpe Global: NTD TV Group from Nueva York. Karen Tsang, Ganjingworld Corp, in charge of OTT and technology; Joe Wang, acquisitions director form the main free TV station NTD; Patrick Daniels from Second Chance, UK; Yan Lieser, head of business development, Ganjingworld Corp |

|

|

|

|

|

|

|

|

The US market itself? Roy Ashton, from the US agency Gersh, describes a current picture: ‘This is a very difficult moment for big content developers, because the strike stopped products that instead of launching last May, can be released still now, but the mid-season is not a good time to launch for the networks. So, you can’t sell new content if the previous wave is still to come. The great winners of this situation are the SVODs, because they saved production costs but continued billing. Just Netflix made cash of USD 1.5 billion due to this. What can do the agencies as ours? To push international TV business, but there are lower budgets, or to go into other segments, as sports or social media’.

|

|

|

European broadcasters at Natpe Global: Karolina Stallwood, head of acquisition, SVT Swedish Television; Maria Bjerre-Nielsen, director of acquisitions, Danish Broadcasting Corp; Katie Keenan, group director of acquisitions Uk & ROI, Sky TV. |

|

|

|

|

|

|

|

|

Rising content trends? • Anything combined with sustainability, global warming, works. Anything, even bizarre mixes. • All the tech, robotic tips, are very demanded for entertainment formats. • The big formats, as bigger as possible, are priority for free TV prime-times. • The personality shows: realities, home & health, anything with famous people: singers, millionaires, etc. Especially, music personality shows are on top. • The ‘True Crime’ now is not only for pay TV or digital, but also for free TV, getting unique rating numbers. • Scripted and unscripted converge… entertainment shows look for fiction hits: emotions, conflicts, iconic characters. • Beyond the new media, it is important not to forget the basics: ‘You have to programar your channel for the people that look at your channel. If a reality is targeted 16-20, won’t work in any free TV or VOD, if they are mainly for -14 or +40 people… ‘.

|

Nicolas Smirnoff, Alejo Smirnoff, Francisco Ferreyra

|

|

|

The Brazilian Globo TV lunch & screening at Content Americas: the actor Cauã Reymond with Angela Colla, head of business unit, Globo; Vanessa Tierno, director of acquisitions, Nicky Correia, executive producer, both from SIC Portugal; Duda Pereira, head of PR and events, Globo. |

|

|

| |

If you want to receive our Daily Reports, please send an email to newsletter@prensario.info with your email and contact details

|

|

This publication has been copyrighted and may not be copied, electronically stored, mailed or faxed without prior written approval. The information may be quoted in internal reports. Prensario Zone must be mentioned as the source. For questions or more information, send an e-mail message to: newsletter@prensario.info | © 2024 Prensario International

|

|

|