Ramadan 2025 has cemented its status not only as a period of spiritual reflection but also as a significant digital content phenomenon, according to a new report from DICM (Dubai International Content Market). Audiences increasingly utilized diverse platforms and engaged with various content formats, signaling an evolving landscape for culturally relevant and faith-driven programming.

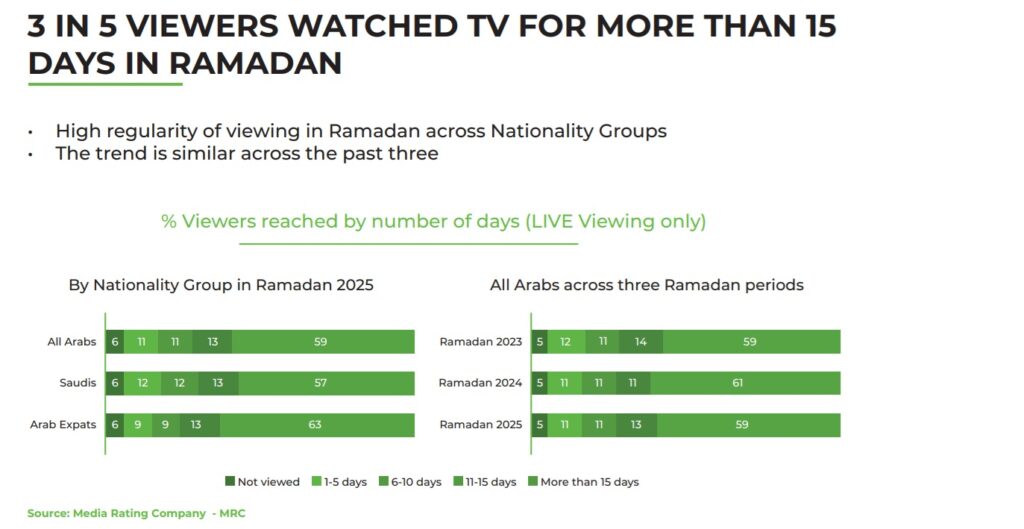

Traditional television and streaming platforms both recorded record-high numbers during Ramadan 2025. The period saw 13.3 million unduplicated TV viewers tune in, with an average of 9.1 million viewers daily. Individuals spent an average of 4 hours and 35 minutes daily watching TV. The holy month collectively generated a staggering 72.7 billion Total Rating Points (TRPs). Notably, 56% of viewing time occurred via satellite television, while 44% came from streaming services, unequivocally proving digital’s cemented role in Ramadan storytelling. A consistent trend over the past three years shows that three out of five viewers watched TV for more than 15 days during Ramadan, indicating high viewing regularity across all nationality groups.

In 2025, dramas and entertainment shows remained the leading content categories. In the series segment, Yawmyyyat Rajol Anis (MBC) led with an 8.93% rating. Jak Al Elm and Share’ Al A’sha followed, solidifying MBC’s strong performance. Saudi networks also gained traction with titles like Al Zafer and Layali Al Shumaisi.

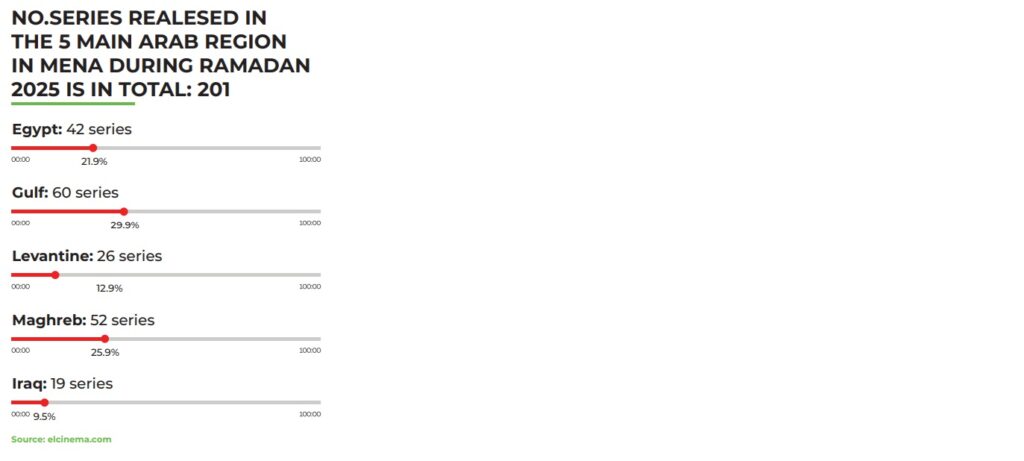

For entertainment shows, Ramez Elon Masr (MBC) topped the category with 5.43%, followed by Hekayat Wa’d, Seen, and Tahaddi Al Manatiq. Saudi Arabia’s SBC also made a mark with Ifttarona Ghayr and Nakhwah. Across regions like Egypt, Nigeria, Morocco, and Senegal, comedy, cooking shows, hidden camera pranks, and religious talk shows all thrived. A total of 201 series were released in the five main Arab regions in MENA during Ramadan 2025, with the Gulf region leading with 60 series (29.9%), followed by the Maghreb with 52 series (25.9%), Egypt with 42 series (21.9%), Levantine with 26 series (12.9%), and Iraq with 19 series (9.5%).

Digital and social media’s growing influence

Digital and social media platforms played a transformative role in Ramadan 2025 content consumption. Prime time viewing continued to dominate post-Iftar, primarily driven by family dramas and live shows. However, streaming experienced a significant surge late at night, particularly among younger audiences. While MENA’s screen time during Ramadan is largely fueled by historical dramas and spiritual content, APAC countries like Indonesia and Malaysia showed a preference for short-form, digital-first Ramadan content on platforms such as YouTube and TikTok. African Muslim-majority countries emerged as leaders in digital-first storytelling, effectively blending modern formats with traditional narratives.

VOD platforms, including Shahid, StarzPlay, OSN+, and Netflix MENA, made substantial investments in Ramadan originals. Egyptian broadcasters like MBC Masr, ON TV, and CBC launched over 40 high-budget dramas. YouTube and TikTok saw a significant surge in viewership, with North Africa alone recording a 50% rise in Ramadan-specific content. Over 50% of Ramadan viewership in APAC and MENA now occurs online. Beyond dramas, faith-based content such as Quran recitations and Islamic talk shows gained considerable traction, especially in North and West Africa. Food content also saw an explosion, blending traditional recipes with influencer-driven cooking segments, while comedy skits and short-form pranks soared on social media.

Advertising and consumer sentiment

The global media spend is projected to reach $1 trillion this year, with MENA contributing significantly to this figure. Regional ad spend is expected to hit $1.1 billion, with influencer marketing accounting for up to 40% of marketing budgets. However, the report also highlights a growing sentiment among consumers: 71% feel there are too many ads during Ramadan, suggesting potential content fatigue and over-commercialization.

Social media platforms remain the primary source for brand discovery, with 28% of MENA audiences engaging with brands via these channels during Ramadan. Furthermore, 55% of consumers rely on online sources for brand information, reinforcing the critical role of digital media in shaping brand perceptions and purchasing decisions.