The OTT video streaming market in Southeast Asia, encompassing Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam, is projected to surpass 50 million subscriptions by the end of 2024. This milestone will represent a market value of approximately US$1.9 billion, highlighting the region’s significant growth potential.

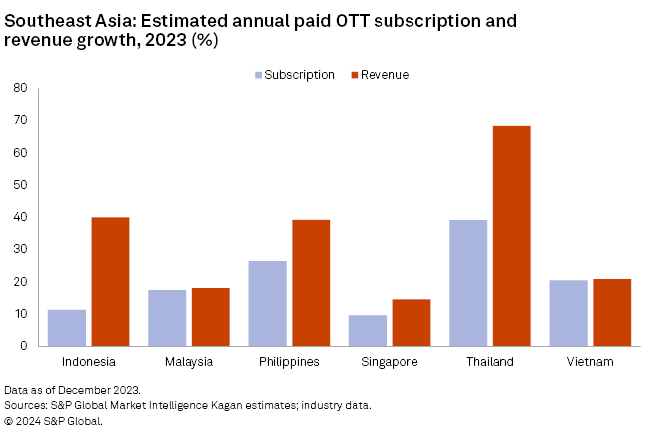

A new analysis from S&P Global Market Intelligence reveals that the annual revenue growth for subscription streaming services in Southeast Asia has surged by 38%, reaching $1.53 billion. This growth rate outpaces the 21% increase in total paid subscriptions, which amounted to 44 million by the end of 2023.

To maximize value from new and existing subscribers, many streaming platforms in Southeast Asia have recalibrated their pricing strategies. Despite these adjustments, subscriptions have remained affordable, allowing major services like Disney and Netflix to raise or introduce new fees in key markets without deterring subscribers.

S&P Global Market Intelligence also emphasized the critical roles of advertising and partnerships with local third-party operators and content producers in driving growth for streaming services in this emerging region.

However, the adoption of paid ad-supported streaming tiers may face challenges in Southeast Asia in 2024. Most consumers in the region continue to prefer the freemium model provided by local and regional platforms. Global streaming services are more likely to rely on mobile-only plans as a cost-effective strategy to attract price-sensitive consumers to their platforms.

Kym Nator, an analyst at S&P Global Market Intelligence, noted, “Achieving subscriber scale remains important in the long run, but many streaming players in Southeast Asia have pivoted their focus to finding the right balance between expanding customer bases and generating higher average revenue per user amid mounting pressure to maintain healthy profit margins.”

Revenue growth and cost optimization are key themes shaping the strategies of top streaming operators in Southeast Asia for 2024. As the region’s high smartphone penetration and the ability to provide services across mobile and smart TVs offer significant opportunities for contextual targeting and multi-device measurement, these capabilities are crucial for assessing the effectiveness of advertising campaigns and maximizing return on investment (ROI).

In conclusion, the OTT video streaming market in Southeast Asia is set for substantial growth, driven by strategic pricing adjustments, strong local partnerships, and innovative service models. With the market expected to surpass 50 million subscriptions by the end of 2024, streaming operators in the region are well-positioned to capitalize on the increasing demand for high-quality digital content.