In the 1990’s, the annual NATPE (National Association of Television Programming Executives) conventions became famous in the United States as a mandatory meeting point for television executives from the world that could acquire the most successful TV shows and series broadcast by the ABC, CBS, NBC and Fox networks.

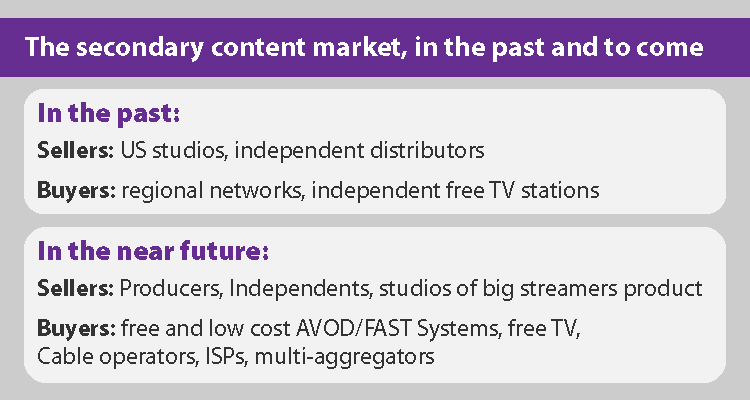

In those days, in the States there were regional networks and hundreds of independent stations in need of programming. This represented a secondary market, known as “syndication television”. It also offered the international buyers – just like the studios’ “Screenings” in Los Angeles, later in May – the chance to acquire, within a single trip and in a single place, the programming for their season at different parts of the world.

This scenario is coming back in 2023. But, this time the sellers will start to be the producers of the series and movies that have been released on streaming, in addition to the film studios and hundreds of independent producers who have invested in content for online consumption, to later discover that the income —even if it covered the production costs— did not meet their expectations. On top of this, the worldwide streaming SVOD ‘giants’ have already emerged from the bonanza-brought pandemic, through the forced isolation of hundreds of millions of people and the resulting sharp increase in demand for home entertainment in 2021 and 2022.

At present, online audience figures from companies such as Parrot Associates show that only between 15 and 30% of the total releases have met their producer’s viewership (and resulting income) expectations. This points out that a latent demand remains; but, their own platform can’t be expected to absorb it because now subscriber growth is much slower than expected and competition is much harder than initially imagined.

The rise of AVOD (Ad-sponsored Video on Demand) and FAST (Free Advertising-Supported Television) services, being launched massively in many countries, is a market response to this complex situation.

This secondary market is also fueled by:

The cable operators, initially losers regarding streaming but remaining supported by their local TV channels and connectivity services, adding their own OTT offers.

The ISPs (Internet Service Providers) offering connectivity but now expànding beyond this business limited by geography and income from your region. In addition, after the initial euphoria, the ‘giants’ have the need to sharply lower their production costs, and are now willing to accept joint ventures with producers and TV stations from different countries, with a partial transfer of rights in certain territories.

The Scandinavian countries have perfected these deals, with various TV networks getting the rights for their respective territories and the platform exploiting ‘the rest of the world’.

Like everything that emerges or re-emerges, this secondary market needs to adjust to reality: in the future, there will be thousands of free or low-cost AVOD and FAST services, and therefore with little ability to pay. This will stimulate the growth of distribution companies, such as those through which Turkish dramas are distributed today, to enable the connection.

The long time expected ‘multi-aggregators’ will finally sprot out at some moment, probably without the «premium» content that the platforms launch as a novelty, but combining programming already exploited at a more accessible price for users who cannot afford more than three SVOD subscriptions at the regular list price. Linear pay TV will stabilize in each nation at a level dependent on the importance of locally-oriented content (compared to national and international programming available) available otherwise for the population. Discarding linear TV as a client is at this point a risky choice.

As measured, it is the elder population that shows the greatest predisposition to tune into content chosen by others; but, it must also be reckoned that the average age of the population is increasing mostly everywhere, and the cable operators offering attractive entertainment options to their subscribers.