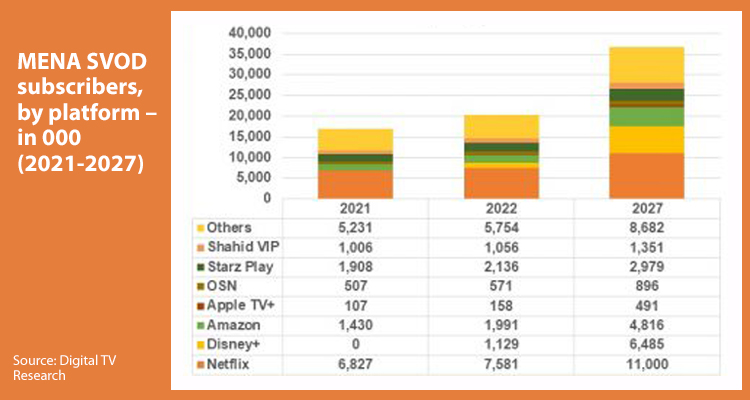

SVOD revenues for 20 MENA countries will grow by USD 2.3 billion between 2021 and 2027 to reach USD 4 billion. Leader Turkey will triple its total to USD 1.27 billion by 2027, according to Digital TV Research. Prensario published the experiences of two leading players to better understand the regional business.

Simon Murray, Principal Analyst at Digital TV Research, added: ‘Netflix will generate half – USD 1.90 billion – of MENA’s USD 4 billion SVOD revenues by 2027. Second-placed Disney+ will be a long way behind with USD 589 million’.

The region will have 36.70 million SVOD subscriptions by 2027, according to the company, of which Netflix will account for 30% of this total; Disney+ that will start in the Arabic countries, Israel and Turkey in 2022, will quickly grow to 6.5 million subscribers by 2027, while regional StarzPlay will have 2.98 million subscribers (excluding its operation in Pakistan) by 2027, this is 1 million more than in 2021.

Interviewed by Dubai International Content Market (DICM), Prensario highlighted the moment of two leding players. First, OSN’s Rolla Karam, Interim Chief Content Officer, who remarked: ‘Technology and content are the two critical pillars of growth in MENA. Over half the population is under the age of 25 which means that new methods of consuming content are beginning to pop up and are a fantastic opportunity for our growth’.

‘OSN broadcast channels are designed in ways that respond to the viewer trends as is our digital arm which again addresses consumer needs with a different perspective. Pay TV certainly in this region has been viewed as a premium service accessible to more affluent and slightly older demographics, while OSN+ democratizes our content by making it widely accessible to the young and the many – that is quite a fundamental growth for us and a testament to our ability to evolve’, he completed.

OSN+ is the group premium streaming service that replaced the streaming app to embrace the explosive growth opportunities presented by the growing MENA landscape: ‘We prioritize long term partnerships with the greatest studios in the world, and we are growing our proposition with the best of premium global entertainment, locally curated’, she summarized.

Karam pointed out: ‘The new streaming service is our commitment to bringing world class entertainment to a much wider audience through a refreshed interface and an enhanced user experience with the main objective to showcasing our incredible content’.

And she described about the content strategy: ‘We continue to have the most compelling content from global studios and we have begun to complement that with premium local originals. We are focused on the evolution of Arabic content within the region and we are walking the same direction of all the brilliant streaming services that provide a home for premium originals that will be recognized globally’.

OSN+ Originals features world-class Arabic original content which will be produced locally by leading creative talent from the region. ‘The growth in MENA is spectacular and we believe that the region will be no different to the US in having audiences engaged on 4.5 subscriptions per household, leading with streaming services and complemented by Pay TV’, she concluded.

On the other hand, Tareq Abu-Lughod, co-founder & CEOof Arab Media Network (Jordan), confirmed the MENA market is ‘unique’ and of ‘great potential and challenges’.

He agreed with Karam by saying it is made up of a young population that is highly connected and engaged digitally: ‘Yet it is one challenged by low credit card penetration and high piracy. Historically, major productions of the year are produced as 30-episode series consumed mainly during the month of Ramadan. But times are changing and the landscape is evolving’, he added.

With many OTT players opening up in, to and from the region, there is a ‘noticeable dynamic’ in the industry that has fueled the demand for local / regional content: ‘Global players as Netflix are increasingly sourcing and producing local content from the MENA, while major regional players are making major investments in shorter form series, outside of the month of Ramadan and tackling more controversial issues. (Shahid). And others like Istikana are carving out niche, genre-specific content as a differentiating factor for their offering’.

About the monetization, he added: ‘Micro payments through mobile operator billing are offsetting the low credit card penetration issue, to an extent. It seems that we will witness steady growth in original local / regional content production and more diverse / specialized offerings’.

While the MENA awaits, like the rest of the world, how major OTT players will play out their competition globally, local / regional platforms will need to enhance their offering by investing in differentiated, relevant, high quality local productions, fast: ‘There is no doubt that OTT will continue to grow in the MENA naturally and organically, especially if the piracy issue is addressed seriously. The question is how much of this growth will benefit local / regional OTT players’, concluded Abu-Lughod.