The television industry in the Americas is undergoing a profound transformation, shaped by the rise of digital alternatives, shifting consumer behaviors, and evolving business strategies. In the United States, the growth of virtual multichannel video programming distributors (vMVPDs) continues to reshape the live linear TV market, while traditional pay-TV providers adapt through new bundling and streaming strategies. Meanwhile, Latin America finds itself at a pivotal moment, with declining traditional TV subscriptions counterbalanced by a growing embrace of streaming and IPTV.

Prensario repasa los datos recientes que dan fe sobre las enormes transformaciones que está experimentando el segmento en el continente, y cuáles son las oportunidades que pueden aprovechar los jugadores nuevos para monetizar su negocio.

The U.S. market: vMVPDs gain ground, traditional Pay-TV adjusts

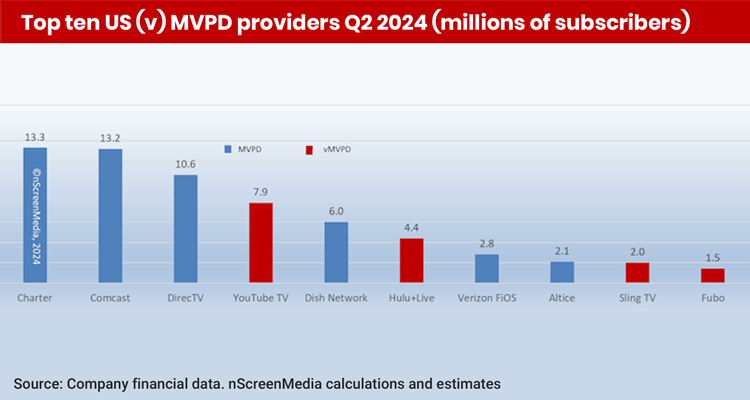

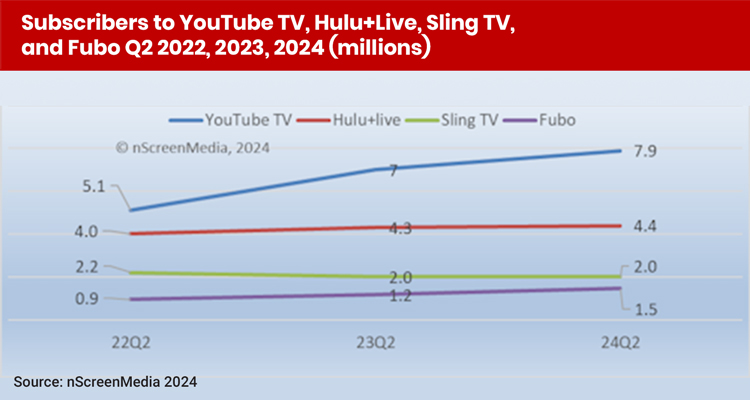

The U.S. television market has seen a notable shift in recent years, with vMVPDs emerging as key players. By the second quarter of 2024, services like YouTube TV and Hulu + Live collectively reached 17.1 million subscribers, accounting for 13% of U.S. households. Despite a slight decline from their peak of 17.8 million in 2023, vMVPDs remain a significant force in live linear television.

YouTube TV leads the segment with 7.9 million subscribers, bolstered by its 2023 acquisition of the NFL Sunday Ticket, which attracted a surge of sports viewers. Hulu + Live and Sling TV follow, with 4.4 million and 2 million subscribers, respectively. The growing prominence of these platforms is evident in their ranking among live TV providers: YouTube TV now holds the fourth position overall, behind Charter, Comcast, and DirecTV, underscoring the increasing acceptance of internet-based live television as an alternative to traditional cable and satellite.

Traditional pay-TV providers, though still serving millions of households, are in a period of strategic adjustment. Charter remains the largest conventional operator with 13.3 million subscribers, slightly ahead of Comcast at 13.2 million. Despite continued subscriber losses, these companies have sought to integrate streaming services into their offerings to retain value. Charter, for example, now includes Disney+ Basic for Spectrum TV customers, demonstrating a move toward hybrid models that blend traditional and digital content.

However, the broader market faces ongoing challenges. Traditional pay-TV providers lost 1.7 million subscribers in Q2 2024, marking a 3% decline and continuing the sector’s downward trajectory. Pay-TV penetration dropped to 40.8% of U.S. households, compared to 46.8% in Q2 2023. Even vMVPDs, which had previously been in growth mode, saw their first subscriber decline in 2024, losing 0.7 million users in the first half of the year. Analysts attribute this partly to churn among viewers who subscribed to YouTube TV solely for the NFL Sunday Ticket.

Looking ahead, live linear television—both traditional and virtual—could fall below 50% of U.S. households by mid-2025, reflecting shifting consumer preferences and competitive pressures from on-demand streaming platforms. To remain competitive, providers will need to continue innovating and diversifying their offerings, ensuring they align with changing viewing habits.

Latin America: a market at a crossroads

Latin America’s television market is also undergoing a transformation, driven by the decline of traditional pay-TV and the rise of streaming services. While global streaming giants have expanded their footprint in the region, local platforms have also gained traction, creating a highly competitive environment.

Major pay-TV operators in Latin America are responding to these shifts by focusing on connected TV (CTV) and content aggregation. This strategy has helped revitalize the sector, forcing competitors to adapt to new consumption patterns. According to Dataxis, the Latin American pay-TV market contracted by 3.5% in 2023, the largest decline in the past five years. Brazil, the region’s largest market, lost more than 2 million pay-TV subscribers over the past two years, largely due to migration from cable and satellite services to OTT pay-TV options.

Despite this downturn, certain segments remain resilient. IPTV added 1.5 million subscribers across Latin America in 2023, while the OTT pay-TV sector is projected to grow by 10 million subscribers by 2028, demonstrating the continued demand for alternative viewing models. Mexico has emerged as an exception to the overall trend, solidifying its position as the largest traditional pay-TV market in Latin America, with an estimated value of $3.2 billion USD in 2023 and an average of 18.16 million subscribers in the final quarter of the year.

One of the most notable recent developments in the region is the launch of VTR’s OTT pay-TV offering in Chile, which integrates eight streaming platforms—including MAX, Prime Video, Universal+, and Atresplayer—into its set-top boxes. This move reflects the growing role of super-aggregators, as traditional operators seek to bundle streaming services within their ecosystems to retain customers and provide a seamless viewing experience.

The pay-TV landscape in Latin America remains dominated by six major players, which together control nearly 60% of the market. América Móvil leads the segment, operating in 15 countries, while Televisa has seen a decline in market share from 17% to 13.7% over the past five years. Vrio Corp (DirecTV) has faced a 1.5% drop in subscribers, though it has adapted by shifting focus toward OTT services. Other key players include Megacable (5.76%), Millicom (5.75%), and Telefónica (4.66%). In the OTT pay-TV segment, the dominant players are Vrio, América Móvil, Grupo Globo, Telefónica, MVS, Zapping TV, and Watch Brasil.

In addition, the Connected TV (CTV) segment has emerged as a major growth area in Latin America, closely linked to the evolution of pay-TV. The return to a lean-back viewing experience, combined with the familiarity of live content, has contributed to its widespread adoption. According to Comscore, Mexico leads the region in CTV adoption, reaching 67% of viewers, followed by Argentina and Chile at 61%.

The dominance of smart TVs—preferred by 94 out of every 100 viewers—has further solidified the role of CTV, aligning with the rise of AVOD services. Pluto TV, ViX, Tubi, Canela, The Roku Channel, and Crunchyroll have all expanded their AVOD offerings in Latin America, capitalizing on the growing audience preference for free, ad-supported content.

According to consultancy firm, 95% of CTV households in Latin America used at least one AVOD service in the past month, while 50% of viewers expressed a willingness to accept ads in exchange for lower costs. This shift presents a significant opportunity for advertisers and further underscores the convergence of digital and traditional viewing habits.