The distribution of television content has become increasingly complex and multifaceted. The traditional linear TV channels are still an essential part of the media mix, generating more revenue for content owners than ad-funded streaming services, especially in the CEE region.

According to Caretta Research, linear TV channels, along with co-branded FAST channels and VOD services, are key pillars for many successful content brands. This holds particularly true in CEE, where expanding economies and growing TV households are creating lucrative opportunities for channel owners, basically because the tradicional business takes advantage of the 30 million of Pay TV households in the primary CEE markets.

Resilience of linear TV channels

Despite the onslaught of streaming services, linear TV channels remain remarkably resilient and relevant to consumers. For instance, Warner Bros. Discovery’s 2022 financial results showcased a stark contrast between traditional and streaming revenue streams. The TV networks business, primarily driven by advertising and carriage fees, generated $23.2 billion, while the direct-to-consumer streaming business, including brands like Discovery+ and HBO Max (before the merging), brought in only $9.7 billion. Notably, while the streaming business is still loss-making, the TV networks segment is highly profitable.

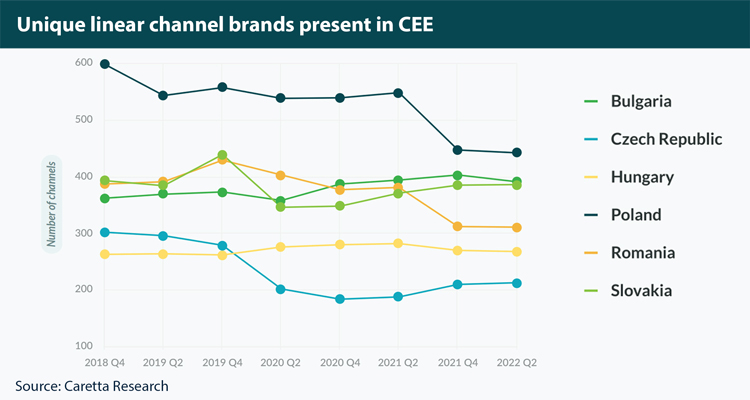

Even as viewing hours for linear channels decline, the number of distinct channel brands remains stable or even grows in various European markets. This stability highlights the enduring value of linear TV channels, which continue to drive significant revenue and play a central role in the media strategies of content owners.

Opportunities in the CEE Markets

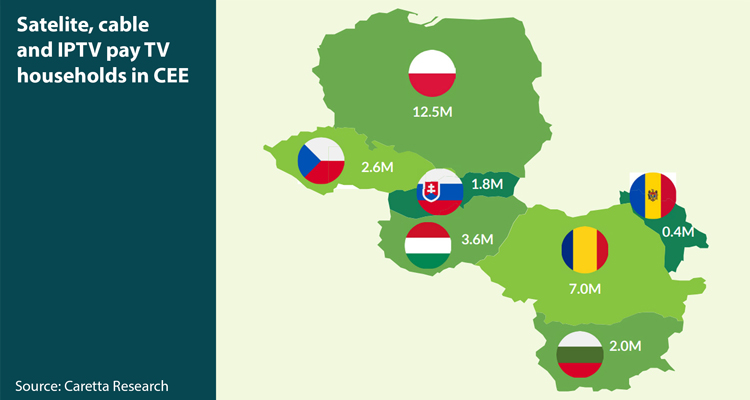

CEE presents a dynamic and expanding market for TV channels. The region is home to approximately 30 million pay TV households across key markets such as Bulgaria, the Czech Republic, Hungary, Moldova, Poland, Romania, and Slovakia. These markets have seen impressive economic growth, with per-capita GDP experiencing compound annual growth rates of 7% to 9% from 2017 to 2022. In comparison, many mature Western European countries have seen growth rates of less than 2%.

In addition to the number of households in the primary CEE markets, there are another six million pay TV customers in Albania, Bosnia, Croatia, Montenegro, North Macedonia, Serbia, and Slovenia. This growth in TV households, coupled with economic expansion, provides a substantial market for channel owners to reach new audiences and tap into additional revenue streams.

Hybrid distribution strategy

To maximize reach and adapt to varying market conditions, channel owners are increasingly adopting a hybrid distribution strategy that leverages satellite, fibre, and internet technologies. Each mode of distribution has its unique advantages and challenges, and the key to success lies in combining these methods effectively.

Even satellite distribution remains a crucial component for reaching a wide audience, especially in regions where fiber infrastructure is less developed. In the CEE region, the 1 West video neighborhood, consisting of Intelsat 1002, Thor 5, Thor 6, and Thor 7 satellites, provides extensive coverage, reaching 16.2 million households via cable, IPTV, and direct-to-home platforms. Satellite’s reach advantage is particularly evident in rural areas and for delivering a wide range of channels to cable and IPTV headends.

For example, choosing a popular satellite orbital position like 1 West allows channel owners to reach more than 50% of pay TV households across the CEE with a single distribution mode. This includes nearly all cable and IPTV headends and two million DTH customers in the Czech Republic, Hungary, Romania, and Slovakia.