In less than three years, the number of available content options for viewers has surged to over 1.1 million individual programs. This surge, while indicative of the booming streaming market, has also led to concerns about oversaturation. With such a vast array of choices, viewers sometimes face indecision or even abandon platforms altogether. According to a recent report by Nielsen titled «Streaming Content Consumer,» 20% of users admitted to not knowing what to watch, opting to engage in other activities instead.

One consequence of this saturation is the abandonment of platforms or unsubscribing due to a lack of fresh content updates. This prompts a critical question for industry players: Have we truly empowered users with control if we fail to meet their demands?

In this report, Prensario examines recent data on the streaming market, its dominance over traditional TV, and the challenges that the segment is poised to confront in the near future.

Consumption patterns

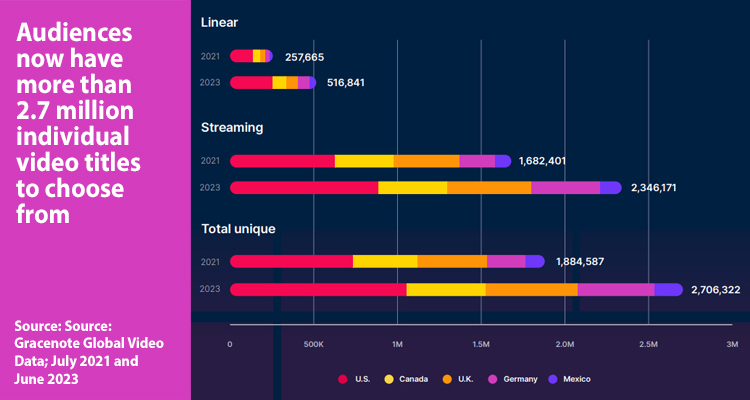

Currently, audiences have access to more than 2.7 million individual videos to choose from, particularly in major markets like the UK, Canada, Mexico, Germany, and the USA. This includes options across cable, broadcast, and streaming platforms, a significant increase from just two years ago. Although the number of options has grown both online and in streaming, the latter accounts for an overwhelming 86.7%.

This surge has presented challenges for linear TV, leading to a decline in followers. To address this, efforts have been made to merge offerings and provide more accessible options for viewers. Examples include content aggregators, Set-Top Boxes (STBs), and Connected TV (CTV). The latter has experienced substantial growth, driven by television manufacturers who have incorporated connected TV features to tap into the surge in streaming content. Some have even ventured into developing their own Ad-Supported Video on Demand (AVOD) services to offer a distinctive experience.

Earlier this year, Digital TV Research predicted that global smart TV penetration will reach 50% by 2026. The USA, in particular, appears to be at the forefront, with over 19 million years’ worth of content in the market last year. This is largely attributed to the 85.8% of households equipped with at least one connected television device, such as a Smart TV or game console.

Beyond the USA, traditional TV (Free & Pay TV) remains the primary choice in terms of consumption and content capitalization. Nevertheless, streaming is making notable strides in this arena. In Australia, 70% of viewers report watching streaming video for an average of 1.7 hours daily. In Mexico, the streaming segment experienced a 21.4% growth rate in the first half of the year, a notable increase from the 15.2% recorded last December. Meanwhile, in Thailand, the OTT market achieved a 50.7% penetration rate in the latter half of 2022, with viewers dedicating an average of one hour per day to streaming content.

Challenges ahead

Saturation has brought about significant challenges. In contrast to traditional TV offerings, streaming appears to have few limitations. The market seemingly has boundless space for new players, FAST channels, and business models. However, on the flip side, the audience is finite and increasingly fragmented as new services are introduced.

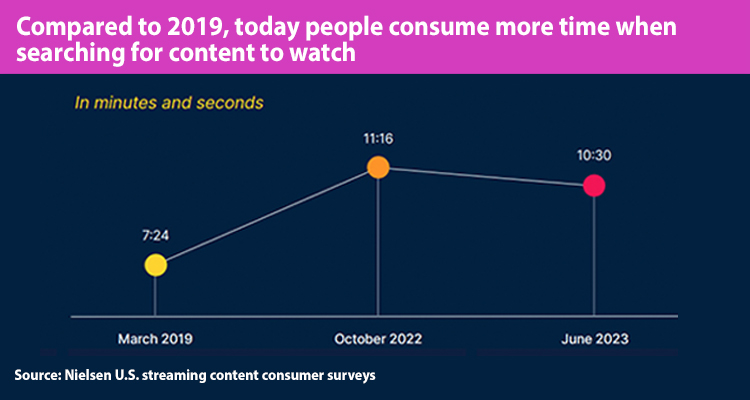

This has led to a shift in how viewers approach the market, which was previously accustomed to attracting large and uniform audiences to specific options curated by content programming executives. On average, individuals now spend 10 and a half minutes searching for something to watch, compared to the 7 minutes they spent in 2019. In response, strategies are shifting towards creating a more personalized experience and aiding users in quickly finding content.

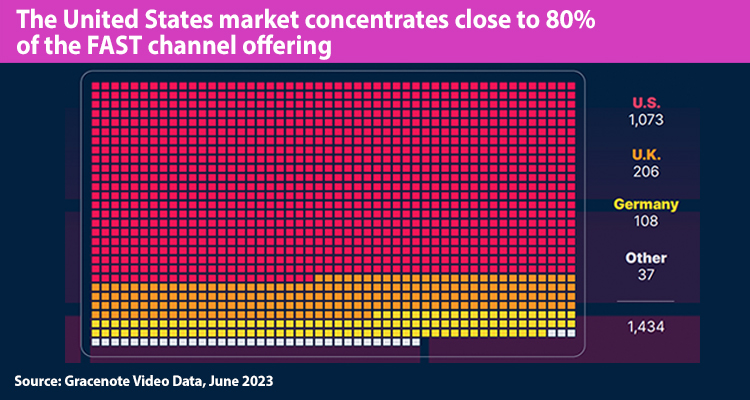

A recent study by Gracenote identified a staggering 39,500 different streaming channels available to audiences in Canada, Mexico, the UK, Germany, and the USA. Last one alone accounts for nearly 80% of this offering. Considering each outlet as a single content source, this translates to over 160 sources, each representing an individual supplier. This further complicates the consolidated viewing experience that audiences expect.

The Future of the Industry

AVOD emerges as a solution for users seeking alternatives to paying for streaming platforms and desiring a return to dedicated programmatic offerings. This has led audiences to revisit certain services and even TV stations. These broadcasters, alongside major players, have embraced offering their linear content through digital channels, utilizing apps and virtual Multichannel Video Programming Distributors (vMVPDs).

In the USA, viewing through SVOD platforms dropped to 49% by the end of May, while consumption of AVOD services surged to 26%. Meanwhile, MVPD/vMVPD usage increased to 15%, reflecting a notable shift in viewer behavior.

For instance, NBCUniversal announced plans in June to launch 48 FAST channels on Amazon Freevee and Xumo Play, featuring themed channels centered around its renowned properties and brands. Similarly, Blue Ant Media introduced various wildlife-oriented FAST channels this year, and Insing TV launched channels dedicated to extreme and niche sports.

As of June 2023, Gracenote Video Data recorded over 1,400 individual FAST channels in its database, with over 1,050 available in the U.S. Some consultants and executives anticipate that the key lies in how AVOD providers understand their audiences, who may come with preconceptions from SVOD platforms. Success will hinge on their ability to swiftly connect with viewers. This has even spurred the emergence of hybrid models for exclusive content distribution, as exemplified by the partnership between WBD and MGM. Together, they will introduce FAST channels on Amazon Freevee, featuring brands like Cake Boss and Say Yes To The Dress—content also accessible on The Roku Channel and Tubi.