The tip of the OTT iceberg

The OTTs are the big emergent segment nowadays, in the content market. But of course, they are not all the same, they are different one vs. the other, and there are many trends crossing them, that can define a good portion of the business future. Let’s see…

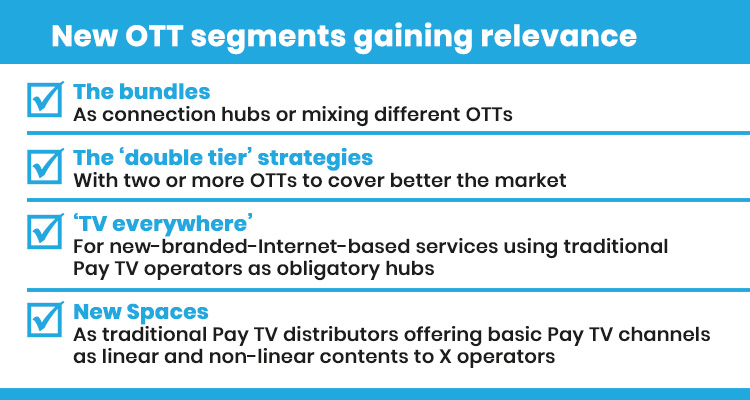

At the OTT map, we see four segments taking relevance, beside or behind the SVOD and AVOD big systems, which took the main headlines:

—The bundles, which are alliances of the OTTs with telcos, ISPs, and cable operators to be connection hubs or even to make combined offers of many OTTs, as own value of the ‘aggregator’.

—The ‘double tier’ strategies, which push the groups to handle two or more OTTs to manage better the market. A good example is Disney+, who launches Star+ to manage all the product that doesn’t want or can’t include at its main SVOD service.

—The ‘TV everywhere’ developments, where big groups of channels launch new-branded-Internet-based services using their traditional Pay TV customers as an obligatory hub, promoting new business to them.

—New Spaces formed for instance, by traditional Pay TV distributors offering basic Pay TV channels as linear and non-linear contents to cable operators, ISPs, telcos, from the big to the small ones, to build their own OTT programming.

What is the value of these options?

—The bundles don’t need to be clarify, in the developed markets they are a key way of access that makes the difference when the market is very competitive. In the emergent territories, they are just appearing, especially telcos or big cable operators switched to local OTTs.

—The ‘double tier’ strategies appear especially when the group handles too much product of different targets, and to have a broader commercial scenario, considering prices or special packs. It is also a return to the beginning of Pay TV business, when the big channels turned to group of channels, to occupy more market.

Star+ surely will be for Disney+ in the international market, the same that today Hulu and ESPN+ are at the U.S. domestic market. We can add the case of HBOMax, which is planning in many territories the launch of an AVOD system, as ‘second tier’ option to the main SVOD.

—The ‘TV everywhre’ developments are different from the OTT because they go to the market just through cable operators, but fast they can turn into a new OTT if the market requires that. In Latin America for instance, the ‘TV everywhere’ Universal+ has been launched with strong promotion this year, born from NBCUniversal Channels.

—The migration of the traditional, basic Pay TV sector to digital is a world itself, with many business options while you know more. There is a big need of content in all the output systems, especially the small and medium players.

That’s why Prensario, in its traditional ‘Protagonists of the Year’ selection at Natpe Miami, included not only the big OTTS as Netflix, Amazon, Disney+ or Paramount+, but also, these emergent traditional PayTV-to-OTT movements. Today, we see just the tip of the OTT iceberg, with a lot new and unexpected to come.

By Nicolás Smirnoff