The audiovisual landscape in Spain has changed dramatically in recent years, with a steady decline in traditional TV consumption and the rise of streaming platforms such as SVOD and AVOD. This report analyzes the differences between the two formats and how they are perceived by the audience.

Traditional TV consumption in Spain has fallen to historic lows. During the 2023/2024 season, the average time in front of the TV was 179 minutes per person per day, with a drop in August to 145 minutes, 9% less than the previous year. Despite the drop, 99.5% of the Spanish population continues to watch traditional television, representing 46.4 million unique viewers. Channels such as Antena 3 and Telecinco continue to lead, with Antena 3 registering a 12.9% share.

Traditional television, while still relevant, faces the challenge of retaining new generations, who prefer flexible, commercial-free content. Live programs, such as soccer matches, continue to attract large audiences, but time spent on other activities on the TV, such as watching streaming content, continues to increase.

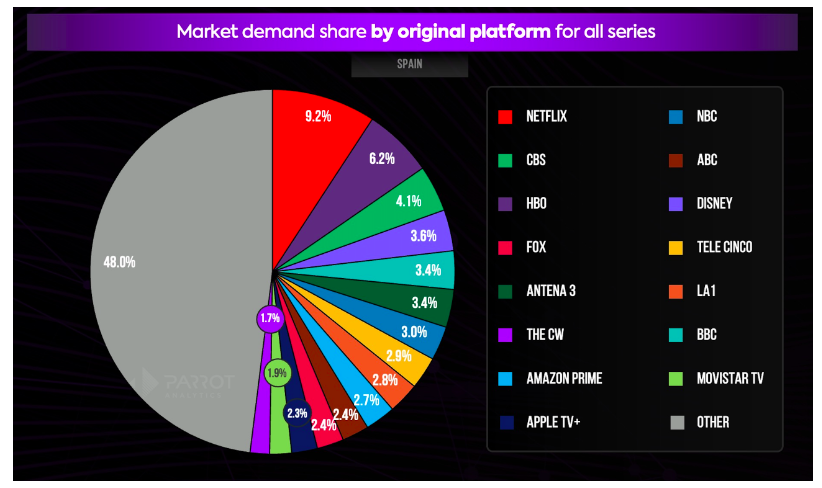

The streaming market, especially in its subscription mode (SVOD), has grown significantly in Spain. Netflix, HBO Max and other platforms have captured the attention of millions of users, who value the flexibility of choosing what and when to watch content without advertising interruptions. At the same time, the AVOD model, which offers free content in exchange for advertising, is expanding with platforms such as Pluto TV.

Advertising investment in streaming is forecast to increase from €26.8 billion in 2024 to €41 billion in 2027, but SVOD platforms have been reluctant to be transparent with their audience data, arguing that their business model does not depend on advertising.

A key difference between traditional television and streaming is the way audiences are measured. Research companies such as Nielsen use representative panels of individuals to obtain traditional TV data, providing standardized and homogeneous measurements. Streaming platforms, on the other hand, collect data directly from their users, allowing them to analyze consumption patterns more accurately, but with the risk of bias if not processed properly.

Big data on SVOD platforms offers granular details about user preferences, although some researchers suggest that more qualitative measurement should be considered, taking into account dimensions such as engagement, popularity and social resonance.

Traditional TV, while still attracting large masses of viewers, especially for sporting or news events, is being surpassed in appeal by SVOD platforms. Users prefer the flexibility of being able to watch what they want at their own pace, without being tied to fixed schedules.

The AVOD model is aimed at those who prefer to access free content in exchange for watching ads, a format that resonates especially with those seeking entertainment without paying a subscription.

TV consumption in Spain is changing rapidly, with a clear decline in traditional TV and an accelerated growth of streaming services. As audiences shift to more personalized platforms, it will be crucial to standardize audience measurement to get a clearer picture of the success of content. The ability of streaming platforms to provide detailed and valuable data on user behavior gives them a significant advantage, but also raises challenges around the transparency and use of this data.