Barb published its last Establishment Survey, which revealed that AVOD services in the UK saw continued growth in the final quarter of 2024. Amazon Prime Video maintained its position as the leader in ad-tier subscriptions, while Netflix and Disney+ showed notable, albeit slower, growth in their ad-supported offerings.

Amazon Prime Video’s ad tier reached 11.6 million UK households in Q4, representing 39.4% of homes, a slight increase from 11.5 million in Q3. However, overall Prime Video subscriptions dipped marginally from 13.4 million to 13.3 million. Doug Whelpdale, Head of Insight at Barb, commented: ‘Set against a modest decline in overall Amazon Prime Video access, this would suggest newcomers to the service are taking the ad tier’.

Meanwhile, Netflix and Disney+ trailed behind Amazon in ad-tier subscribers but demonstrated stronger growth rates. Netflix’s ad tier reached 4.7 million households, up 24% from 3.8 million in Q3, while Disney+ saw its ad-tier subscriptions grow by 26%, reaching 1.5 million homes. Despite this growth, both platforms still have significant room for expansion, as the majority of their users remain on ad-free plans.

‘The Netflix ad tier is now in almost 1 million more homes than in Q3, while the Disney+ ad tier is now in 26% more homes than the last quarter’, Whelpdale noted. ‘The majority of homes on these two services are still using the service without ads, so there is plenty of room for their ad tiers to grow’.

Broader SVOD market trends

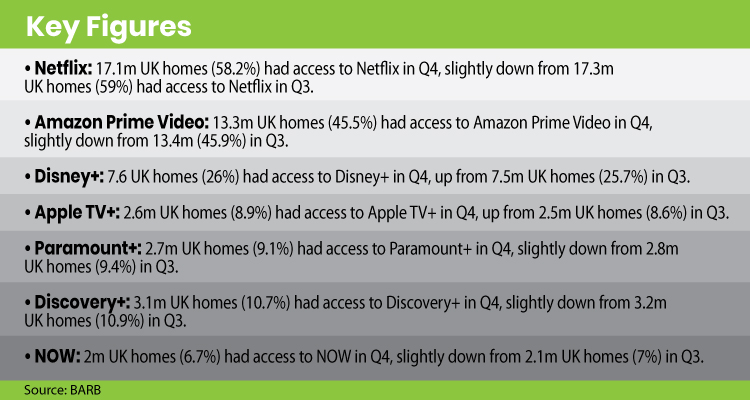

Across the entire SVOD market, including both ad-free and ad-supported tiers, 20 million UK households had access to at least one streaming service in Q4, a slight decline from 20.1 million in Q3. Netflix remained the dominant player, with 17.1 million households subscribed, though this marked a small drop from 17.3 million in the previous quarter.

Other major players included Disney+ with 7.6 million households, Discovery+ with 3.1 million, and Paramount+ with 2.7 million. Apple TV+ and NOW also reported modest figures, with 2.6 million and 2 million households, respectively.

Shift toward Ad-supported models

The country is following the cunrrent trend into the streaming landscape. According to Kantar’s Entertainment on Demand report, one-third of new paid subscribers to TV streaming services opted for ad-supported tiers in Q4, a significant increase from one in 10 a year ago. Notably, more than two-thirds of new Netflix subscribers chose the ad tier.

Barb’s data highlights the evolving preferences of UK viewers, with ad-supported models gaining traction as a cost-effective alternative to traditional ad-free subscriptions. However, the overall market remains stable, with only minor fluctuations in household penetration rates.