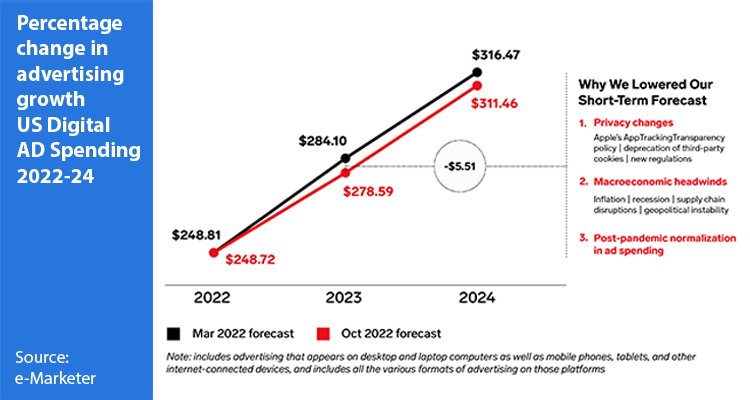

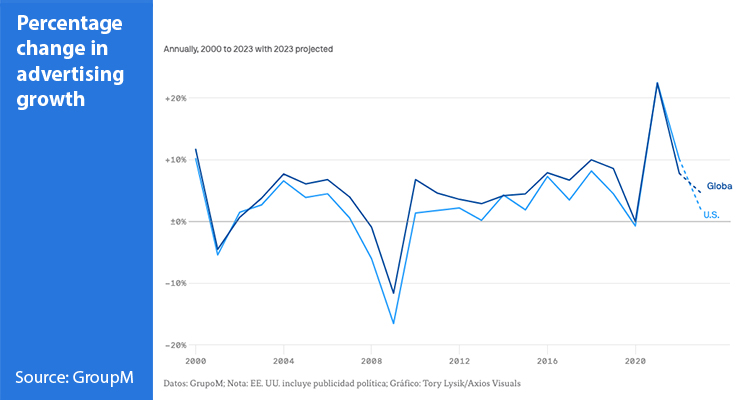

For several years, the advertising market has been in a constant state of flux. Despite sensitivity to economic uncertainty, with rising inflation in operating costs and recession, international advertising faced 2023 with optimism. Marketing lost priority at most companies, and due to the conditions, advertisers scrutinized their budgets while reducing spending on certain channels versus others.

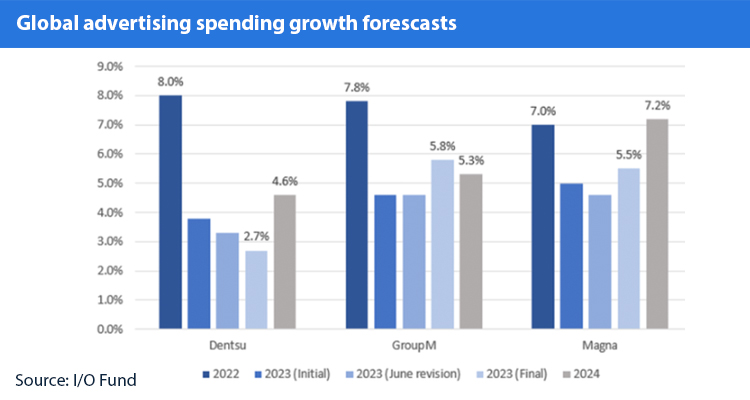

Dentsu‘s latest report, predicts global ad spend growth of 4.6% in 2024, driven by digital advertising, retail media and connected TV. The holding company forecasts growth in the amount to $752.8 billion, roughly the same 4.7% growth it predicted in its May report. This is a conservative forecast compared to that of GroupM, which reported that it forecasts 5.3% global growth in ad revenue for the year as the market adjusts to inflation and global economic conditions, including the ongoing wars between Israel and Hamas and between Russia and Ukraine. Magna from IPG Mediabrands predicted 7.2% ad revenue growth in 2024.

Dentsu‘s report goes beyond examining financial data to analyze advertising movement in relation to broader macroeconomic factors, such as market demographics and gross domestic product. It found that in the coming year, advertising spend will account for 0.75% of GDP in the top 12 global moving markets. This is consistent with the relationship between advertising spend and GDP observed over the past 20 years, with markets such as Japan, the UK and the US spending more relative to their GDPs. The report shows that advertisers are spending more to reach audiences and that audiences are experiencing greater advertising pressure as a result.

Will Swayne, global president of media at Dentsu, said: ‘Audiences are receiving an ever-increasing volume of ads, so finding new ways to drive advertising effectiveness has never been more important. More and more brands are looking to maximize ROI and take advantage of the attention economy tools available to them.’

For its part, and through the data of the “Global advertising spend outlook 2023/2024”,WARC ensures that between 2023 and 2024 advertising investment could exceed for the first time the trillion dollars: it will grow by 4.4% in 2023, reaching 963,500 million dollars. It also predicts that global advertising spending in 2024 will increase by 8.2%, with social networks, retail and digital TV, the formats that will lead growth in the industry. WARC says that advertising spend in Europe will show growth of 0.6% to 3.6% over the next few years, as the economy improves: the UK will experience a decline of 1.0%, while Germany will increase by 2.7%, Italy by 3.2% and Spain by 5.6%.

James McDonald, director of data, intelligence and forecasting at WARC, said: ‘Despite the difficulties of the last 12 months, including high interest rates, rising inflation and war, the latest reporting season shows that the advertising market has weathered this turbulence and turned the corner’.

As the WARC study points out, market growth in 2024 will be boosted by events such as the US presidential campaign, with spending of approximately US$15.5 billion; sporting events such as the Olympic Games and the European Championship; as well as improved business conditions, especially in China. Social networks will be the fastest-growing medium, with total spending of $227.2 billion in 2024. The most prominent companies in this regard are Meta, parent of platforms such as Instagram, Facebook and Whatsapp, with expected advertising revenues of $146.3 billion next year. Bytedance, owner of TikTok, has an estimated advertising investment of 39.9 billion dollars in 2024.