MIPTV officially began with Glance‘s classic “One TV Year in The World” conference, which dissected viewing, export, premiere data, and trends within the global TV industry. In 2023, the consultancy firm reported that the global daily TV viewing time was 2h 21 minutes by total global individuals, 4 minutes less compared to 2022; while regarding Young adults, the average of TV viewing was 1H 27 minutes, 3 minutes less compared to 2022.

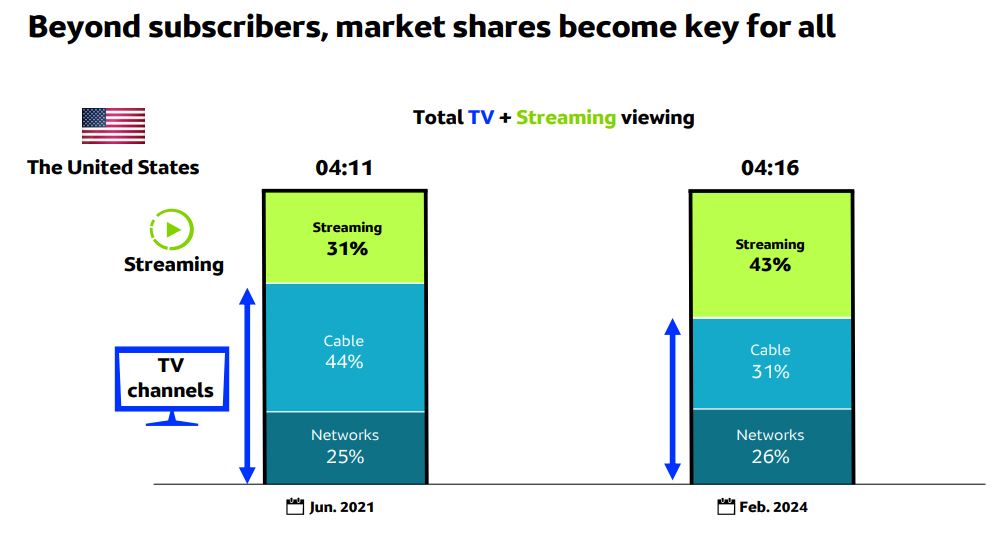

Frédéric Vaulpre, Senior Vice-President of Glance, reported that the total TV + Streaming viewing in 2023, in the United States alone, was 4 minutes 16 seconds, 5 minutes more compared to 2021. Streaming is one of the enhancers of this figure, with a 43% share, followed by cable 31%, and then networks 26%.

‘This is because everyone now has a streamer because they are finding appeal drivers for Young audiences, but also taking benefit of strong live audiences’, Vaulpre explained.

One of the growing trends, especially in Europe, is the BVOD (Broadcaster video on demand) model, a content distribution model in which users access titles online and on-demand from traditional free-to-air broadcasters. This trend is a growing European response from public channels, with players such as TF1+, France TV, My Canal, ITVX, BBC Player, Atresplayer, M6+, RTL+, among others.

This has attracted more content and therefore more audience compared to 2018, due to the extension of the availability window, since some platforms make available Premium content, FAST channels, or pre-linear TV Broadcast.

Another trend that the consultancy has observed is content scheduling, which was successful among SVOD platforms, but seems to have been ironed out, regarding the growth of live streaming, by AVOD platforms or FAST channels.

However, something that keeps TV Channels current is live viewing, which remains dominant. Where the live viewing proportion in total TV viewing in North America among total audience share is 85%, meanwhile among Young adults is 86%. As for Europe 88% (total audience), 84% (Young adults); in Asia is 95% (total audience) and 94% (Young adults); Oceania 88% (total audience) and 87% (Young adults).

This trend is largely driven by live events such as sports, where platforms have taken part of the exclusive rights to tournaments that historically belonged to traditional TV. Amazon Prime Video signed an 8-year exclusivity agreement with the NFL, which in 2023 allowed it to concentrate a good number of live online viewers.

Top launches in 2023

More than 60% of the top-performing programs were launched in the 1Q 2023. The best performing launch is an unscripted series in more than 2 out of 5 territories (up from 2022).

Among the best-performing unscripted releases in 2023 are the entertainment game show The 1% Club (Seven – Australia), the game show Intervilles (RTVE, La 1 – Spain), and the reality competition I can See Your Voice (Keshet 12 – Israel).

One of the trends of this edition of MIPTV is the appetite for Asian formats. The consultancy highlighted the show Battle In The Box, produced by MBN, and distributed by Something Special, which already has an adaptation underway in Spain.

While in terms of factual formats, the documentary Kum Suomi Muuttui (Yle TV1 – Finland) stood out. Also, the production of Silverback Films and The Open University, distributed by Banijay Rights (UK) Wild Isles, debuted on BBC One in 2023.

While in the scripted genre released in 2023, the drama series The Swarm (ORF 1 – Austria), fiction drama series What Will You Do, Ieyasu? (TVP1 – Poland), and soap opera Street Birds (ATV– Turkey).