European Audiovisual Observatory unveiled their anual instructive and very detailed “Yearbook 2023/2024 – Key trends report on the Pan-European’, focused on TV, cinema, video and VOD services. The report highlighted some elements, such as the fact that the still impressive rise in the number of series produced (873 of which feature fewer than 13 episodes in 2022, against 775 the year before) comes with a shortening of their duration.

The text shows the growing interest in shorter formats that takes place in an environment marked by a decrease in series production last year in the USA as a result of the strikes of 2023 alone, or the sign of a potential reversal in the market that could spread to Europe. This is a question that arises also in the realm of cinema production, since the number of European films commissioned by streamers decreased last year (after continuous growth since 2017), going from 80 in 2022 to 69 in 2023.

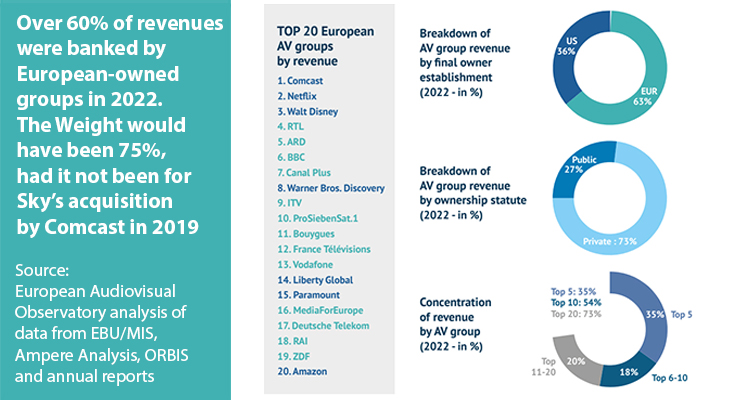

On the whitepaper, the production boom during these past few years saw the constitution of powerful groups in Europe like BBC Studios, Fremantle, Banijay or Mediawan/Leonine, who try to profit from streamers’ appetite for European content in order to compensate for a stagnation in ad revenue. But is the intensity of this growth sustainable, in a context where broadcasters may have to limit their programming spending, and where streamers themselves are streamlining their investments because many of them are not yet profitable? After nearly ten years of euphoria, the question is on the table and the next few years will clarify the situation.

Sin embargo, beyond these worrying signs, que aseguran es simplemente temporal, the situation for European production is particularly solid y fuerte, with an average of 23,000 series episodes appearing each year. De hecho, en 2022, 55% of fiction titles were commissioned by public broadcasters, 32% by private broadcasters, and 12% by streamers.

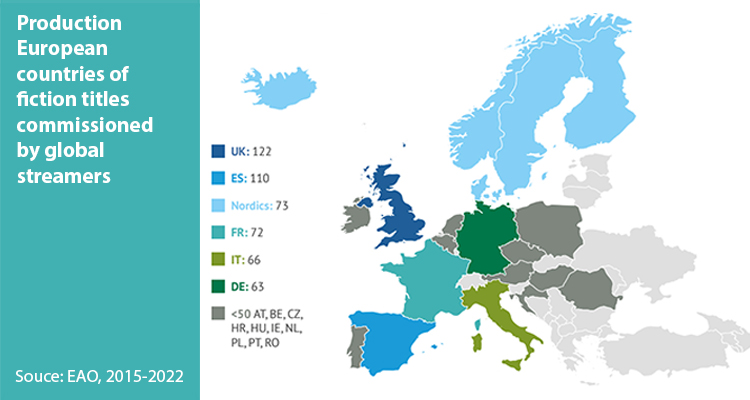

The latter broadcast 186 original European titles on their platforms in 2022 (against 137 the previous year), 62% of which by Netflix and 20% by Amazon. It is also worth signalling a geographic concentration of series purchased by streamers: 27 seasons (of fewer than 13 episodes) in Spain, 25 in the UK, 16 in France, 15 in Italy, 11 in Poland, 10 in Sweden, 7 in Germany. Among traditional broadcasters, the numbers for seasons of all durations were 146 in the UK, 108 in Germany, 70 in France, 46 in Sweden, 43 in Finland, 36 in Spain, 35 in Italy, 24 in Norway, and 23 in Poland.

The scenario presents a paradoxical tableau: a substantial financial injection of 21 billion euros fueled European content in 2022, with streamers contributing 24% of the total. Concurrently, traditional broadcasters, particularly public services in Denmark, Germany, Belgium, and the Netherlands, notably escalated their production investments. However, amidst factors like a constrained pool of European screenwriters and a plateau in coproduced series, the landscape is chiefly defined by the recent public declarations of select American streamers expressing intentions to curtail their financial commitments to non-national productions. Is this a genuine deceleration or merely a transient phase? Only time holds the answer, but it’s prudent to acknowledge that after a period of extraordinary expansion, the adage «trees don’t grow to the sky» retains its relevance.