LA Virtual Screenings 2022 comes to an end, with a positive market balance, but above all with panels and conferences that offered the best trends in production and distribution, consumption habits, new business models and technologies.

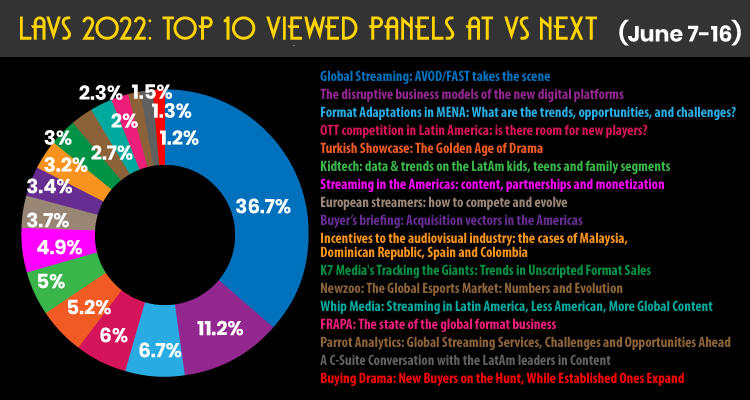

The portion of the market VS Next, which launched new sessions, panels and showcases on June 7-16, was the second most visit section at LAVS 2022: seventeen conferences and twenty testimonials included players such as Disney, Roku, Sony, TelevisaUnivision, among many others.

The two panels on the first day brought together executives from Rakuten, Pluto TV, Tubi, ViX, Samsung TV Plus, and Roku, along with consultancies Omdia and K7 Media, where they touched on topics such as the AVOD and FAST business, and the growing demand for entertainment formats. One of the takeaways was expressed by María Rua Aguete, Senior Research Director, Media & Entertainment, OMDIA (UK), who said: ‘In 2020 the highlight was online overtaken pay-tv, but the trend we are seeing is that online subscriptions will reach 2bn in 2027. Today, the 60% of streaming video revenues come from the fast online video space’.

Meanwhile, on the second day, and with a focus on the new disruptive models in the streaming business, and on content demand trends, there were two panels in which SatorI.O, Flixxo/Carnaval.art, Dailymotion, and Merzigo participated, along with to the media consultancy Parrot Analytics. As takeaways, Nicolas Smirnoff, director of Prensario Internacional, expressed: ‘The new models within the digital business are being promoted and transformed. Now we see new players that involve technologies such as cryptocurrencies or GVOD (Gamified video on demand).” Meanwhile, Alejandro Rojas, VP of Applied Analytics at Parrot Analytics, added: ‘Although we are experiencing a saturation of SVODs, this is generating new opportunities for more flexible business models, and it is also generating opportunities for independent products’.

The third day of LAVS, had, on the one hand, the majors of Turkish drama at a global level, Inter Medya, Calinos, Madd, Eccho Rights, Kanal D, Global Agency and MISTCO, who highlighted their most recent novelties. Carolina Acosta-Alzuru, College of Journalism and Mass Communication, University of Georgia, moderator of the talk, said: ‘Turkish dramas continue to consolidate themselves as the most watched content in various markets. Even in some territories, these titles are not exactly in primetime slots, and yet they still manage to raise outstanding ratings’. Meanwhile, Fabricio Ferrara, International Business Director, met top exec from Globoply, OTTera, The Roku Channel, in a panel that reviewed the different strategies of these players.

For the fourth day of the market, FRAPA, together with K7 Media, Hayley Babcock, and the Korean producer Something Special, starred in a panel where they spoke about the current moment of formats and their protection strategies and opportunities for IP writers. ‘We want to inspire executives to be good global citizens in the format business’, underlined Phil Gurin, CEO The Gurin Company, and FRAPA Co-Chairman.

While the second talk, co-organized with Conecta FICTION & Entertainment and moderated by its founder and director, Geraldine Gonard, had executives Atresmedia/ATRESPlayer Premium (Spain), SIC/OPTO (Portugal) and Good Move / COO iXMedia/Serially , who offered their impressions as new streamers in the European market: ‘Europe is a market that has historically always been more prone to Linear TV, but we are seeing new players that are attracting attention, both for their Premium programmatic offer, and for their business models, where those of partnering stand out’, stated Gonard.

The keynotes of the seventh day revolving around audiovisual incentives in Colombia, Malaysia, the Dominican Republic and Spain, where Film In Malaysia Office, ICEX, ProImágenes and Just J, offered their impressions of these policies that are encouraging the industry in material of production. Whip Media’s Media Research and Insights Lead, Eric Steinberg, led another session where he highlighted the dynamics of content consumption in Latin America, as well the strengths of the region and the players that are dominating the market.

Likewise, the eighth day featured prominent players in MENA and APAC: the first panel was a conversation Sarawak Media Group (Malaysia), Krishi Dutt, director of VROTT (India), with Yesim Sezdirmez, Deputy General Manager at Kanal 7 (Turkey ) about the content needs in this growing region. In addition, Heba Korayem, content market specialist at H.Consult, moderated the other one of the keynotes where she had as guests exec from Tvision, Art Format Lab and Eagle Films Middle East. ‘MENA has large media balance with +700 satellite TV channels, +15 regional OTT platforms, +20 telcos IPTV networks, +100 production companies, and +50 popular Arabic dubbing houses, which make this territory one of the most promising in the industry,’ Korayem said.

The Kids&Teens sector and eSports also had their space at LAVS. Both content sectors are moving large investments and creating engagement between audiences, brands and audiovisual companies. Demian Faletshi, CEO and Co-founder of Kids Corp, moderated the panel, who was accompanied by his team within the consulting firm. ‘It is important to take a look into this audience segment within the advertising guidelines of some brands, because they already consume advertising in different media and make decisions, so they become relevant consumers in different industries such as retail, toys, videogames and TV content’, expressed Faletshi.

Hugo Tristao, eSports market lead at Newzoo, presented data on the current moment of eSports in the world in another of the key panels during LAVS 2022. ‘eSport audience to cross the half a billion mark in 2022, and APAC region is one of the main markets because it has one of the largestst eSport audience, with nearly 43% of global share’, he said.

Lastly, key executives from Exile Content, Sony Pictures Television and Estrella Media, highlighted their content production strategies for Latin America and the lands view with OTT players arise.